Why Is Auto Insurance So Expensive?

Posted:June 20, 2024

Categories: Insurance, Inflation, Federal Reserve

Paul Hancock, CFP® June 20, 2024

As the owner of an insurance agency, this is a very legitimate and often-asked question. Let’s first try to answer the question through the lens of price inflation on auto insurance as measured by the U.S. Bureau of Labor Statistics and their output of the Consumer Price Inflation (CPI).

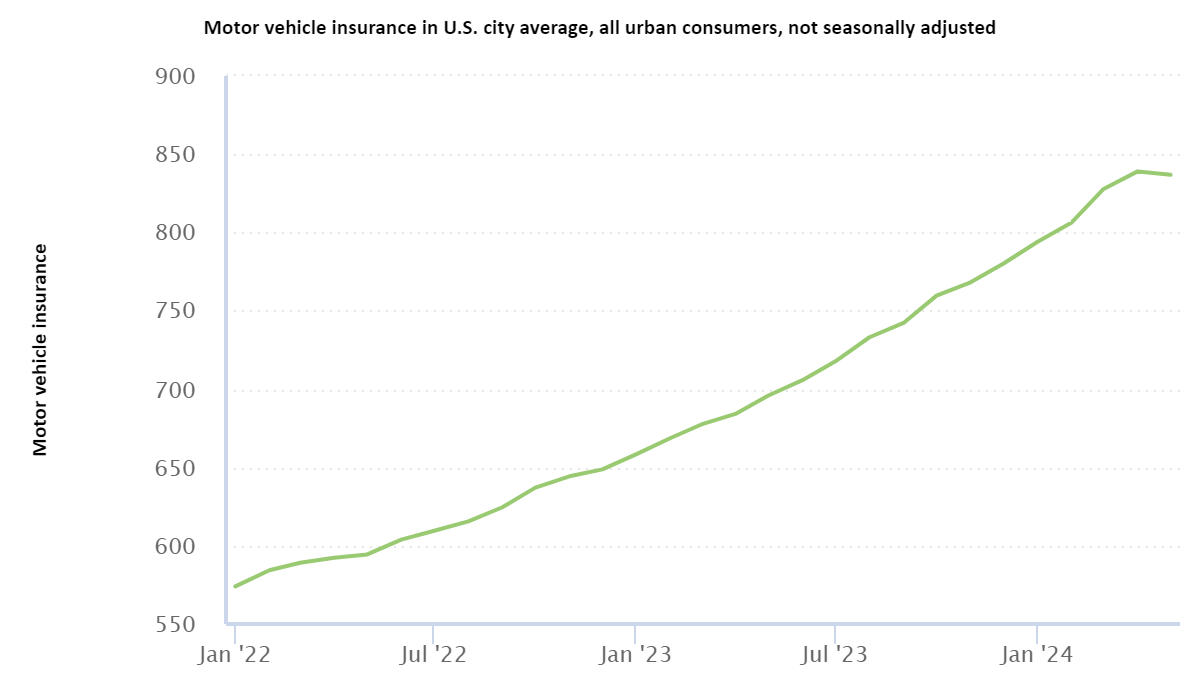

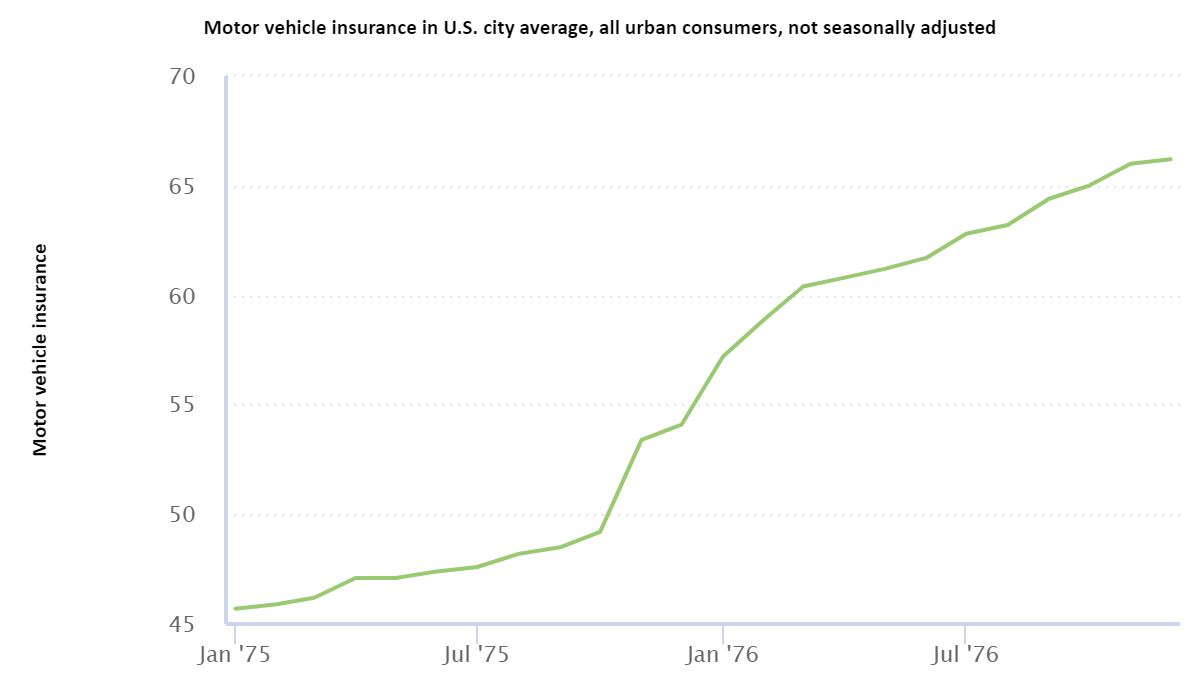

As shown below in Figure 1, car insurance has risen by 20% year over year as of the end of May 2024. This figure has been consistently double-digits for some time now. I tried to find a comparable period for this data set and had to go back to the mid-1970s. The inflation rate in 1975-1976 was 30% year over year. This makes sense given the general level of price inflation during the 1970s. This was after Nixon closed the gold window in 1971, directly off the heels of the oil embargo, and during the recession of 1973-1975.

Figure 1: 12-Month % Change - Motor Vehicle Insurance (as of May 2024)

Source: U.S. Bureau of Labor Statistics

Figure 2: 12-Month % Change - Motor Vehicle Insurance - Jan 1975 - Jan 1976

Source: U.S. Bureau of Labor Statistics

Lag Effect of the Money Printer

As I’ve stated before, my view of inflation is simple. Inflation is when the Government or commercial banks create too much money and credit. Inflation is not rising prices. Rising prices are the result of inflation. One way to look at money creation is through the lens of M2 Money Supply. M2 consists of currency (dollars) in circulation in physical form or bank reserves, checking accounts, savings deposits, small-denomination time deposits (CDs), and money market funds. Essentially, short-term liquid cash either physical or digital.

M2 money supply (cash and cash equivalents) expanded at:

- Annual rate of 8.5% compounded from 1971 through the end of 1976.

- Annual rate of 17% compounded from January 2020 to January 2022.

The latter was a response to COVID-19 and bank reserves expanded dramatically through Central Bank Quantitative Easing (“QE”) and the direct deposit of stimulus payments to US citizens. What I’ve learned in the insurance business is that insurance premiums rise on roughly a 1-2 year lag effect depending on the line of insurance and event. Therefore, the increases from 2022 onwards make sense.

Maintenance Costs

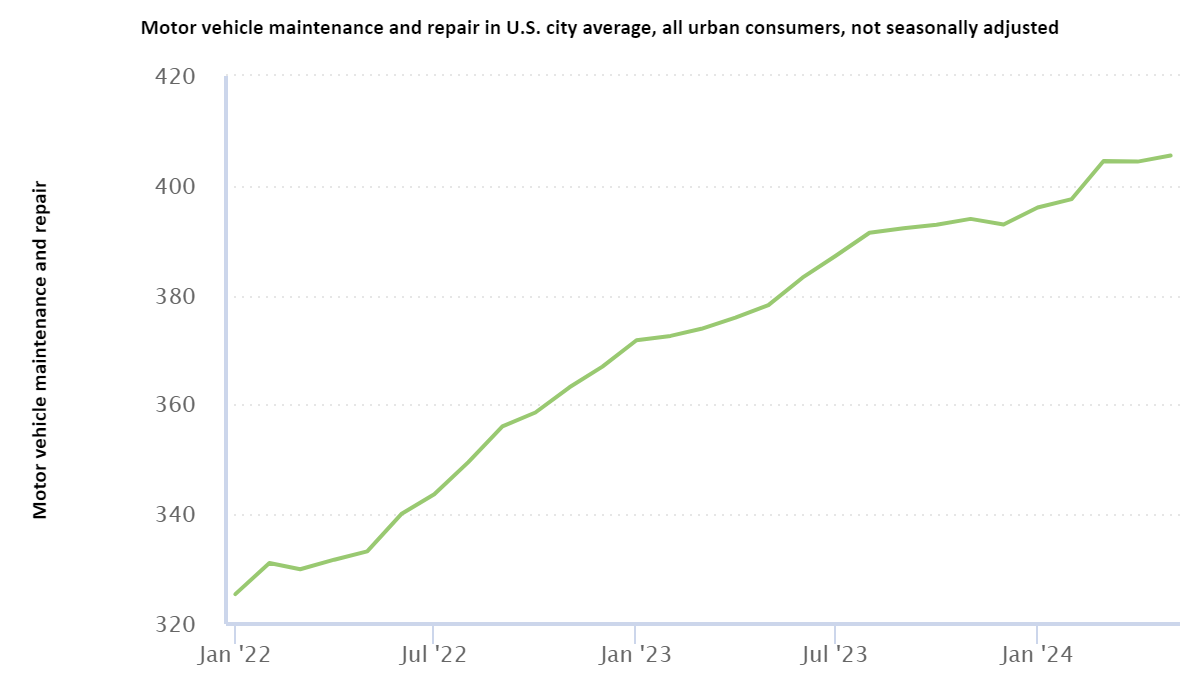

Another reason for higher insurance costs is the cost to repair cars has increased as seen in Figure 3 below. The cost of motor vehicle maintenance is rising at an annual clip of about 10%. Many vehicles built in the past few years are much more complex than cars made in the past, from computerized dashboards to turbocharged engines. The complexity and cost of parts add to the cost of maintaining these newer cars. Throw in the rising labor costs of mechanics and you’ve got a recipe for higher payouts from insurance companies.

Figure 3: 12-Month % Change - Motor Vehicle Maintenance

Source: U.S. Bureau of Labor Statistics

Claim Severity

According to a report from the Insurance Information Institute, the severity of claims has risen substantially since 2013.

“Claim severity has risen 72 percent since 2013, for a compound annual growth rate of 6.2 percent. The median increase was 6.3 percent, with spikes in 2018 (14 percent) and 2020 (13 percent). Four of the last five years exceeded the median increase, a sign the process may be accelerating. This suggests that the growth in the average auto claim has nearly tripled economic inflation in that period.”

Further in this report, the authors note that since 2020, premiums have declined by 13%, but the losses born by the insurance companies have risen by 15%. They conclude:

“A business where losses are climbing while prices are falling is unsustainable. Insurers have been raising rates in response to increasing inflation.”

Litigation

Rising litigation costs are another major reason for higher premiums. Litigation is a large problem in the State of Florida. The number of billboards with personal injury advertisements is remarkable in Southwest Florida. According to a separate report by the Insurance Information Institute:

“Overall, the direct economic costs of the tort system have grown at an annual rate of six percent a year over the period 2016 to 2020, with commercial liability growing at a faster rate than personal or medical professional liability… This rate exceeds both the growth in inflation during that period”

Conclusions

The problem for many consumers is that auto insurance is an ongoing expense. Overall consumer price inflation has moderated in the 3.5% year over year range this year. However, the M2 money supply flattened out and is now on the rise. Further, it seems the Federal Reserve is itching to lower rates. My hope is the dramatic price inflation of the past couple of years in auto inflation starts to ease and much like the lag effect from 2020 to 2022, we’ll experience a similar lag effect in 2024-2025 with less rapid price inflation. This will hopefully help to bring down premiums.

References

- U.S. Bureau of Labor Statistics

- Insurance Information Institute - “Impact of Increasing Inflation on Personal and Commercial Auto Liability Insurance”

- Insurance Information Institute - “Legal System Abuse: State of the Risk”

DISCLOSURES & INDEX DESCRIPTIONS