Market Brief - September 2024

Posted:September 2, 2024

Categories: Market Update, Federal Reserve, Interest Rates

Jackson Hole, Wyomin'

Fifteen wagons an' forty-five orn'ry mules

Jackson Hole, Wyomin'

Ten more moons an' we gonna rendezvous

Jackson Hole, Wyomin'

Four flat tires an' a worn-out Chevy coupe

Jackson Hole, Wyomin'

Ten more moons an' we gonna rendezvous

McCall, C.W. “Jackson Hole”

I was first introduced to the music of C.W. McCall on a youth group trip in my teens. One of our youth group leaders had an affinity for country music by C.W. McCall. Mostly it was his song “Convoy” which he liked to play as we drove off to Devil’s Lake Wisconsin in search of some good old summer fun. “Convoy” as it would happen was the first track on the CD, followed of course, by “Jackson Hole”. For the record, I’ve played both songs to my kids and they naturally just roll their eyes at “crazy Dad”.

I remember this song around the same time every year when economists and central bankers descend upon Jackson Hole for an annual meeting. This is always an important meeting as the chair of the Federal Reserve typically gives a speech that tends to move markets.

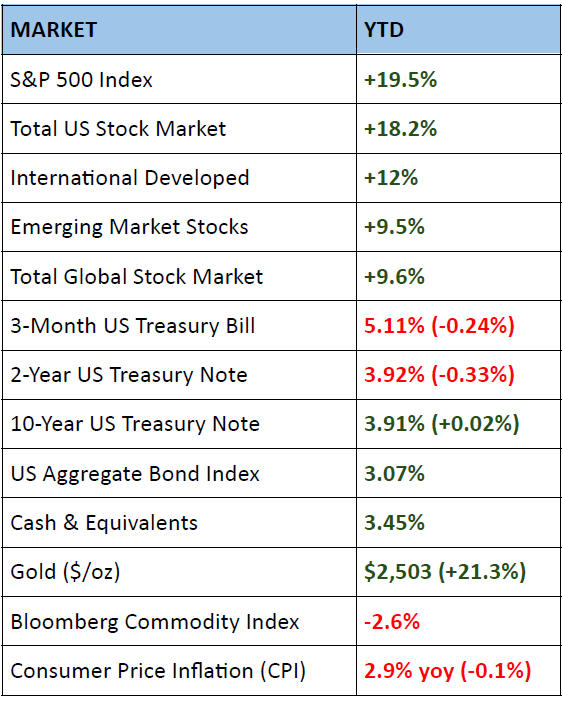

The most important line from his speech this year was “the time has come for policy to adjust.” This leaves no doubt the Federal Reserve will begin cutting interest rates on September 18th. That “comfortable” feeling of 5% risk-free returns for investors will soon evaporate. The market is now pricing a 45% chance of a full 1% (100 basis points) of interest rate cuts by year-end 2024. This would decrease rates from 5.25 - 5.5% to 4.25 - 4.5%. By year-end 2025, the market is pricing in a 26% chance of rates at 3.25%. We shall see.

For context, see Figure 1 below for historical returns of stocks, bonds, and cash (treasury bills). Is a 5% return on cash poor, average, or above average? Looking at the data, 5% is higher than normal over long periods. The chart below shows real returns (after inflation). Look at the time period between both 1900 - 2023 and 1974 - 2023. With an inflation rate of 2.5%, cash returned on average 3% per year. The Federal Reserve would have to lower rates by a full 2.5% to get back to 3%.

Figure 1: Annualized Real Returns (%) for the United States

Source: UBS Global Investment Returns Yearbook 2024

Turning back to Jackson Hole. For context, the Federal Reserve is tasked with the following mandate:

- Price Stability - Their target is a 2% price inflation

- Maximum Employment

- Stability of Financial Markets

The Fed believes they have tamed inflation for now Consumer Price Inflation (CPI) is 2.9% and their preferred measure, US Core PCE is 2.6%, which is “close enough” to their 2% target. They’re much more focused now on their mandate of maximum employment. So, they believe that now is the time to start lowering rates.

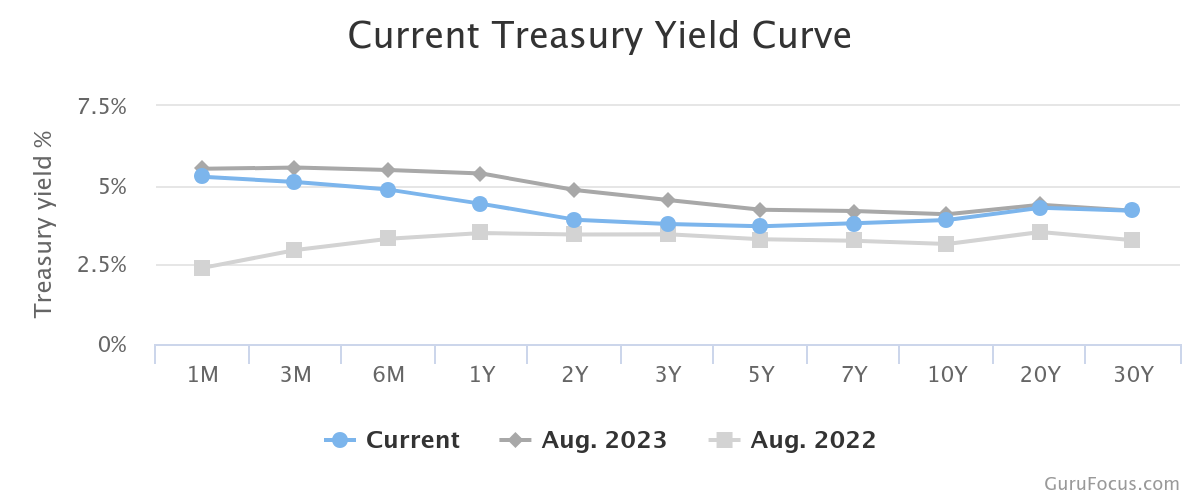

The US Treasury market has begun pricing in future rate cuts and yields have moved lower on the short to intermediate parts of the curve relative to one year ago. The 2-Year US Treasury note which historically is a good predictor of future fed funds rates, has dropped from 5.1% at month end August 2023 to its current rate of 3.9%. Clearly, the bond market believes lower rates are coming.

Figure 2: US Treasury Yield Curve

Source: Gurufocus.com

Stocks

The GDPNow forecast of future GDP growth stands at 2.5% at month-end. This is signaling a “soft landing” economy. Markets shrugged off the volatility at the beginning of the month as the S&P 500 ended up higher on the month. Most stock markets are well into the green this year hitting near all-time highs. However, history also shows that stocks perform poorly once the Fed starts cutting rates. Further, September and October, seasonally have been very volatile months for markets. As is typical, predicting short-term moves in stocks is very difficult. Long-term investors can once again ignore short-term noise.

Gold

Gold continues to shine hitting all-time highs this month ending around $2,500 per troy ounce (figure 2 below). The yellow metal is up 21% in 2024. Continued monetary inflation and lower yields have been a couple of catalysts. Short-term, technically, gold looks to be overbought with leveraged, momentum investors very net long. The inverse of the gold, of course, is the US Dollar (or other fiat currency). The Dollar Index has retreated in the past few months. A broad basket of commodities has dropped 2.6% this year.

Figure 4: Gold US$

Source: Macleod Finance

Sources: Kwanti Portfolio Analytics, TradingView

Quote of the Month

“Central Banks have power, but they do not always have control. And, often they exercise unelected powers.” Michael Howell

- McCall, CW. “Jackson Hole”. The Best of C.W. McCall. Polydor Records, 1997.

- Powell, J. (2024, August 23). Review and Outlook. Jackson Hole Economic Symposium, United States of America. https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

- Dimson, E., Marsh, P., & Staunton, M. (2024). Global Investment Returns Yearbook 2024. In UBS. https://www.ubs.com/global/en/investment-bank/in-focus/2024/global-investment-returns-yearbook.html

- Federal Reserve Bank of Atlanta. (2024). GDPNow [Dataset]. https://www.atlantafed.org/cqer/research/gdpnow

- CME Group. (2024). FedWatch Tool (Version 2024) [Dataset]. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

DISCLOSURES & INDEX DESCRIPTIONS