Market Brief - November 2024

Posted:November 7, 2024

Categories: Gold, Inflation, Market Update, S&P 500, Stock Market, US Treasuries

“Next Tuesday is election day. Next Tuesday all of you will go to the polls; you'll stand there in the polling place and make a decision. I think when you make that decision, it might be well if you would ask yourself, are you better off than you were 4 years ago? Is it easier for you to go and buy things in the stores than it was 4 years ago? Is there more or less unemployment in the country than there was 4 years ago? Is America as respected throughout the world as it was? Do you feel that our security is as safe, that we're as strong as we were 4 years ago? And if you answer all of those questions yes, why then, I think your choice is very obvious as to who you'll vote for. If you don't agree, if you don't think that this course that we've been on for the last 4 years is what you would like to see us follow for the next 4, then I could suggest another choice that you have.” (Ronald Reagen, 1980)

During the only debate between Ronald Reagen and Jimmy Carter leading up to the 1980 election, Ronald Reagan delivered his famous line, “Are you better off than you were 4 years ago?”. In 2024 it appears that history has rhymed. With inflation raging in the 1970s and early 2020s, Americans once again voted with their pocketbooks. Americans also like a good comeback story. While I won’t delve too deeply into politics, Tuesday night was a remarkable comeback story. Not only did Donald J. Trump win, he won convincingly.

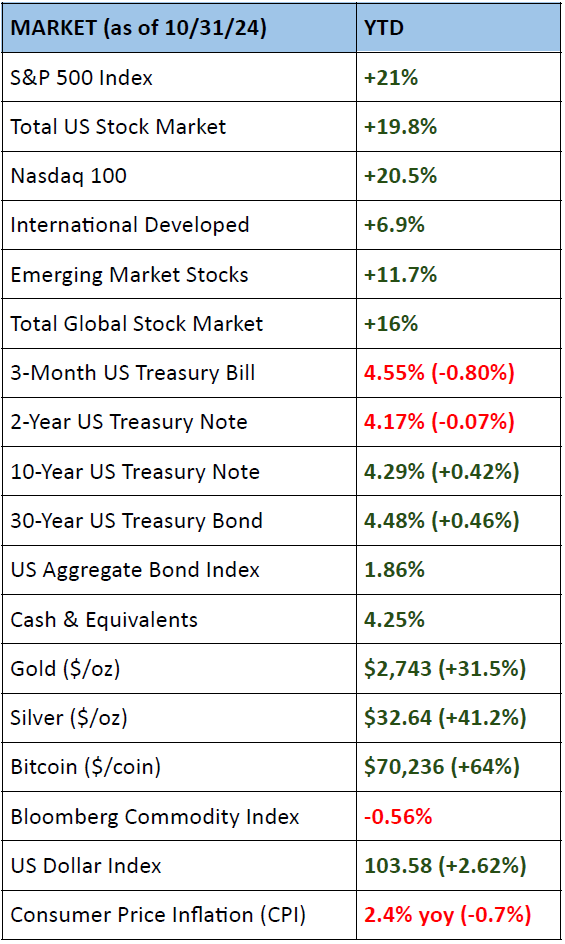

While the stock market was closed Tuesday evening, other markets were open. It was fascinating to see the reaction of the open markets such as the bond market, currency markets, gold, and bitcoin as the night wore on. Much of the market reaction was “euphoric” on Wednesday, but it was an interesting day. Let’s quickly look at the market reaction across various asset classes.

Stocks - The stock market soared following Trump’s victory led by the Dow Jones and small-cap stocks. Many markets continue to hit all-time highs. Certainly “animal spirits” were alive and well as a Trump victory is perceived as good for deregulation, lower taxes, and generally good for business. The rally in small-cap stocks is intriguing as interest rates spiked on the day. Many small companies rely more heavily on debt and with interest rates moving higher you would think this would hurt small caps. Nevertheless, small-caps could be playing catch-up to their larger counterparts. A strong dollar and the questions surrounding tariffs hurt international markets, but most were only down modestly and still are up big on the year. Diversification is important and holding a basket of both US and international equities historically has helped dampen volatility.

Figure 1: S&P 500 Index (5-Year)

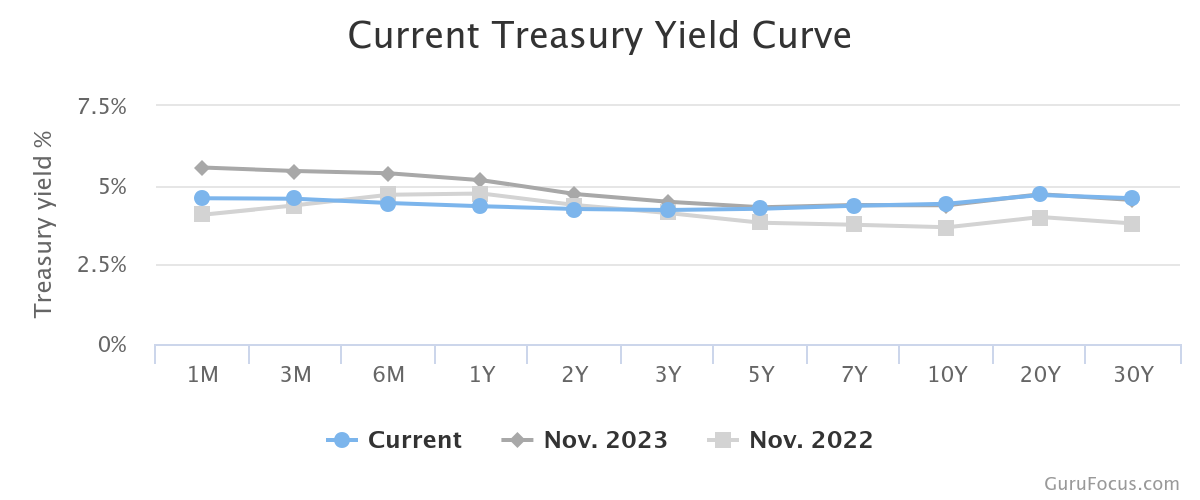

Bonds - US Treasuries sold off as interest rates rose. The long end (10 yr+) of the bond market sold off much more than shorter maturities as questions abound about future inflation. This trend has been in place since the last rate cut with the 10-year moving up from 3.6% on September 18th to 4.4% on Wednesday. This is certainly concerning. However, investors continue to demand higher rates for putting money to work in longer-term bonds. The entire US Treasury curve is in the 4% range.

Figure 2: US Treasury Yield Curve

Source: Gurufocus.com

US Dollar - The wrecking ball that is the US dollar was hard at work on Tuesday night and again on Wednesday as the dollar strengthened against most currencies. Most notably the Japanese Yen and Chinese Yuan. As I’ve said before, a strong dollar, while good for the United States, wreaks havoc on the rest of the world and is very deflationary. I would imagine more strength in the short term, but don’t be surprised if the monetary authorities work to suppress the dollar to help interest rates stay in check and bond market volatility lessen. Lower rates and lower volatility in US Treasuries are incredibly helpful for the government to issue bonds.

Gold - Gold sold off on Wednesday down 2.7%. After rising a robust 31% year-to-date, gold was due for a pullback. With a Trump victory, investors are also betting on a decreasing chance of a world war. Gold generally gets a bid with heightened geopolitical risks. A strong dollar and rising interest rates also generally hurt gold. With monetary inflation essentially “baked into the cake,” I expect gold to continue to march higher in the coming years.

Figure 3: Gold US$ (5-year)

Bitcoin - Bitcoin soared on election night and into Wednesday hitting an all-time high. I view Bitcoin as a pure play on global liquidity. The markets clearly view Trump as a pro-liquidity and expect more stimulus and deficit spending to come. The rise was aided by some seeing Trump and some Senators as “pro-crypto” which was not the case for the last administration. Bitcoin also typically rises when the stock market rises. It will be interesting to see what happens on the regulatory front over the next four years.

Economy & Central Banks

Just one last comment on the economy and the Central Bank. The Federal Reserve is expecting to lower interest rates today which is incredible to say with the economy humming along in most sectors and many markets at all-time highs. Of course, the risk, similar to the 1970s is that the Fed eases into a good economy and re-ignites inflation. I believe the risk to this has increased which is probably why the bond market has risen since the last Fed meeting and risk asset markets have moved higher. Moving interest rates up or down 0.25% isn’t going to move the needle, but in today’s markets the narrative moves much more on the Fed’s “forward guidance” and the massive amounts of liquidity sloshing around in the global markets.

Sources: Kwanti Portfolio Analytics, TradingView

Quote of the Month

“Are you better off than you were 4 years ago?” Ronald Reagen

- Ronald Reagan Presidential Library. (1980, October 28). 1980 Ronald Reagan and Jimmy Carter Presidential Debate. https://www.reaganlibrary.gov/archives/speech/1980-ronald-reagan-and-jimmy-carter-presidential-debate

- GURUFOCUS.COM. (n.d.). US Treasury Yield Curve [Dataset; Online]. https://www.gurufocus.com/yield_curve.php

- Kwanti Portfolio Analytics

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS