Market Brief - January 2025

Posted:February 2, 2025

Categories: Markets, Bond Market, Stock Market, Market Update

Central bankers are all the rage these days. I wouldn’t be surprised if Dude Perfect has Jay Powell on their YouTube channel to perform trick shots while discussing monetary policy. As the kids say, I’m waiting for the video “to drop.”

Kidding aside, the power instilled in central banks has grown tremendously. I’m sure former President Andrew Jackson would be rolling over in his grave today if he knew the power such a small body of individuals has over the global financial system. For context, Andrew Jackson closed the Second National Bank of the United States (precursor to the Federal Reserve Bank) when he failed to renew its charter in 1836. Jackson was a strong advocate against centralized financial power in finance and government. In a somewhat ironic twist of fate, Jackson’s face adorns the current $20 bill, a fact he may not like if he were alive today.

What’s lost in the market worrying about interest rates is the Federal Reserve’s power to affect the supply of money and credit. The level of short-term interest rates is essential. Still, the Fed can expand its balance sheet in times of stress, infusing liquidity into many institutions, including failed banks, insurance companies, and other systemically important entities. As I’ve stated, our financial system is awash in debt, especially at the Sovereign (government) level. This level of indebtedness is true for almost every country. If history is any guide, government debt rarely gets fully paid off, especially near the end of the long-term debt cycle (Dalio, 2020). Government debt is typically extinguished with a combination of inflation through financial repression, currency devaluation, monetization, and, in rare cases, default.

Investors allocate capital among many markets, including government bonds. The U.S. 10-year Treasury Bond has been the global store of value for years. While this may be waning among global central bank balance sheets, sovereign debt should still play a vital role in protecting capital for investors within a diversified portfolio. Further, government bonds provide collateral for leverage throughout the global financial system. I’m not sure we’ll ever see a world without government debt in one form or another.

Let’s turn to markets to see how the first month of the new year played out.

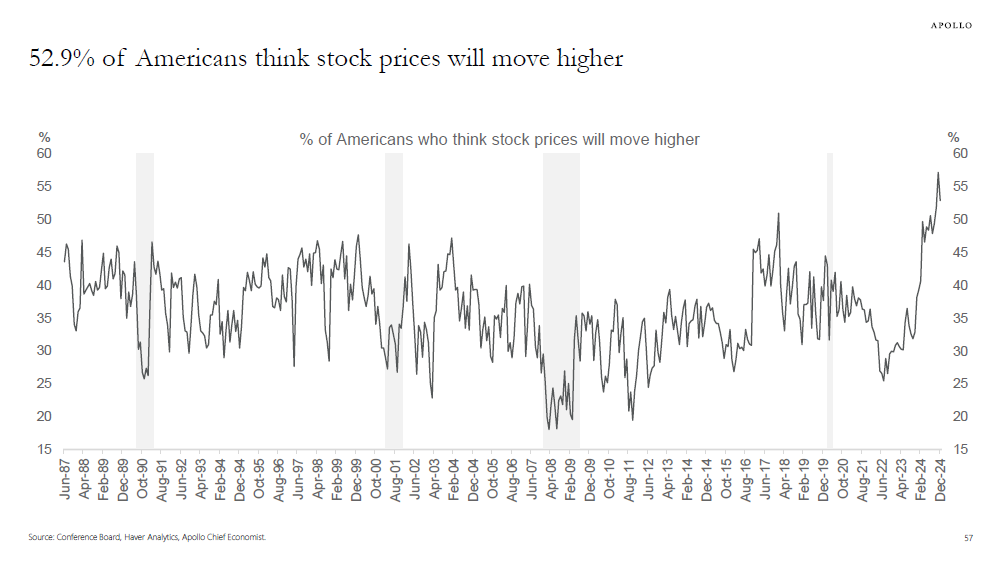

Stocks

Stocks experienced healthy gains in the first month of 2025. The market spent most of the month attempting to digest news from Washington and the proposed Trump policies. International stocks rebounded and were the best performers from the major market indices. The bull market remains long in the tooth. Investors can suffer from recency bias; the chart below in Figure 1 represents this. Americans are more optimistic about future stock market returns than at any point in the past 40 years. With tariffs set to start on Canada, Mexico, and China, expect markets to be volatile both up and down throughout the year.

News out of China roiled markets near the end of the month. DeepSeek, a new AI-based model developed in China that is similar to OpenAI’s Chat GPT, was released. The model is reported only to cost $6 million to train compared to over $100 million for Chat GPT and others. This cost differential challenges U.S.-based companies that have already developed models under the assumption that they require immense capital expenditures. DeepSeek is also “open source,” meaning it’s free to use via a web browser or API. The availability of a free, open-source AI like DeepSeek can potentially undermine the revenue models of companies that charge fees for their AI services. Technology stocks dropped the day after the announcement, and this development could be a longer-term issue for large growth companies, especially those exposed to AI. Tech stocks have led much of the rally in the S&P 500 over the past few years.

Figure 1: Record Optimism in Stocks

Source: Apollo

Bonds

The bond market was quiet at the start of the year. At its first meeting of the year, the Federal Reserve held interest rates steady. President Trump calls for lower interest rates from the Fed, but the Fed is an independent body, so this dynamic will be interesting to watch over the next few years. Lower rates would certainly help reduce government expenditures. Corporate bond spreads remain historically tight.

US Treasury yields persist in the 4% range, with longer-term interest rates remaining elevated. The benchmark 10-year treasury bond has risen from roughly 3.6% to 4.5% since the Fed started hiking rates in September 2024. This has puzzled many analysts. I’ve discussed this issue in past articles, but it’s worth discussing again. The US Treasury has skewed longer-term yields through a combination of unconventional policies. One such policy is issuing more short-term bills rather than longer-term coupon bonds. Secondly, the Fed and Treasury have added liquidity to the market through tools such as the Bank Term Funding Program (BTFP), the Reverse Repo Facility (RRP), and the rundown of the Treasury General Account (TGA). These policies artificially lowered yields and distorted market signals. The bond market senses a slowdown in liquidity from these unconventional policies, which has caused yields to stay elevated. The slowdown in liquidity injections may require the Fed to soon end its quantitive tightening policies. The new Treasury Secretary, Scott Bessent, has his work cut out as he steps into his role.

We must all hold cash: bank deposits, time deposits, short-dated government paper, etc. Holding liquid assets as close to the Sovereign (government) level in the global reserve currency, the US dollar has been a trade many global investors have made over the past few years. With a real rate of return above inflation available in this market, I remain positive on short-dated US Treasuries, even with the comments above about government debt. As they say, the US remains the “cleanest dirty shirt.”

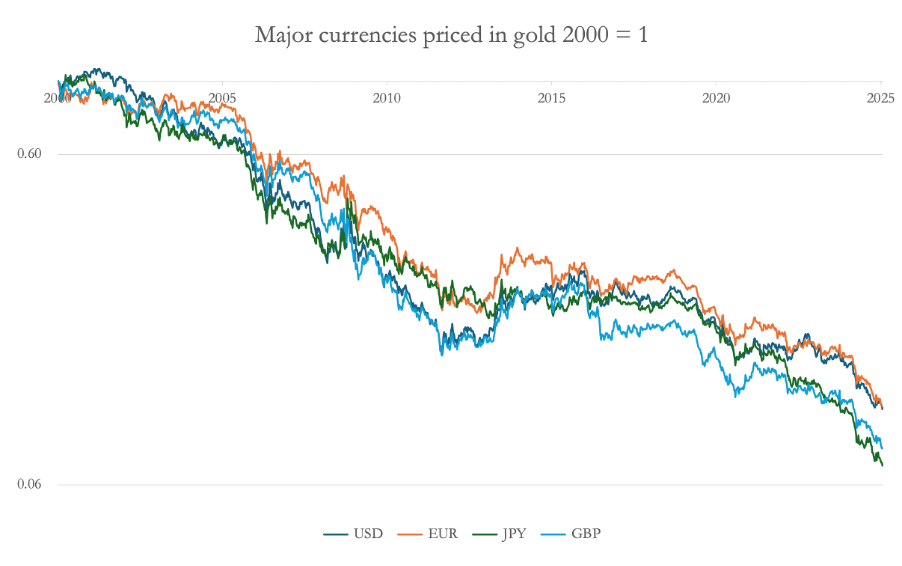

Commodities

Gold continued to rally and hit all-time highs in basically every currency on the planet towards the end of January. While some say this is because the gold price is rising, others argue that the massive supply of currency and credit decreases the value of currencies relative to real assets such as gold, stocks, real estate, and others. The key idea is that the purchasing power of currencies is declining due to the rising money supply. Figure 2 below shows the declining value of major currencies priced in gold since the year 2000.

Fears of tariffs made their way to the precious metals market towards the end of the month. Large institutional players in the gold market have been taking physical delivery of gold back to the United States in fear of tariffs. The Financial Times published an article on January 29th indicating the London Bullion Market Association (LBMA) is experiencing a technical default on cash/spot market gold delivery. This means the LBMA is not meeting its obligations for the physical delivery of gold within the standard time frame. While not getting too much into the details, the LBMA is involved in the wholesale gold market, where delivery typically takes two to three days. Reports are that delivery is now taking four to eight weeks. While not the same, this would be like going to the bank and asking for a large withdrawal only to have the bank tell you they don’t have the money, but never fear, we’ll have it in one to two months. Again, this example is not “apples-to-apples,” but readers get the point. This is not a healthy development. Many feel this indicates the LBMA and/or the Bank of England have created too much “paper gold” via leasing activity exceeding the actual amount of physical gold available for delivery.

Figure 2: Currencies and Gold

Source: MacleodFinance

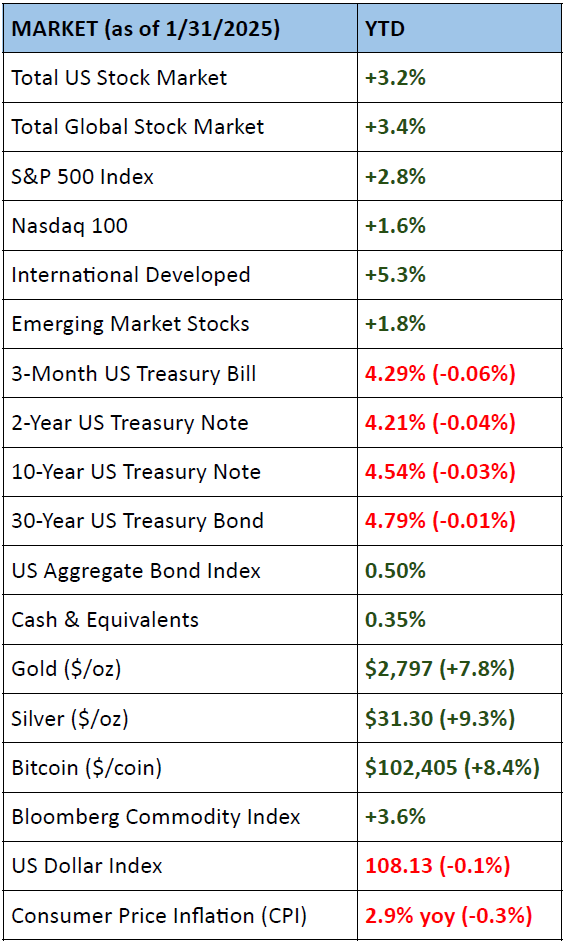

Below is a table of the year-to-date performance of the major asset classes.

Sources: Kwanti Portfolio Analytics, TradingView

Quote of the Month

“A debt is a promise to deliver money. A debt crisis occurs when there have been more promises made than there is money to deliver on them.” Ray Dalio

References

- Dalio, R. (2020). Principles For Navigating Big Debt Crises. Bridgewater.

- Apollo Group

- Macleod Finance

- Kwanti Portfolio Analytics

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS