Market Brief - February 2025

Posted:March 6, 2025

Categories: Asset Allocation, Commentary, Gold, S&P 500, Stock Market, Stocks

Warren Buffett released his 2025 Berkshire Hathaway, Inc. letter last week. I’ve read it consistently for many years. It’s always a quick read with lots of wisdom. I will review a few items from the letter and briefly discuss recent market action.

Warren Buffett was born in Omaha, Nebraska, on August 30, 1930, during the Great Depression. His father, Howard Buffett, started a stock brokerage company, of all things, during this period. Howard also served four terms as a Republican in the House of Representatives and penned an excellent article about the gold standard in May 1948. It was indeed a different and challenging time in our country. A quote from this letter is below:

“I can find no evidence to support a hope that our fiat paper money venture will fare better ultimately than such experiments in other lands. Because of our economic strength the paper money disease here may take many years to run its course. But we can be approaching the critical stage…I warn you that politicians of both parties will oppose the restoration of gold, although they may outwardly seemingly favor it. Also those elements here and abroad who are getting rich from the continued American inflation will oppose a return to sound money. You must be prepared to meet their opposition intelligently and vigorously. They have had 15 years of unbroken victory.

But, unless you are willing to surrender your children and your country to galloping inflation, war and slavery, then this cause demands your support. For if human liberty is to survive in America, we must win the battle to restore honest money.

There is no more important challenge facing us than this issue -- the restoration of your freedom to secure gold in exchange for the fruits of your labors.” (1948, Buffett, H.)

I imagine young Buffett and his family had interesting conversations around the dinner table! In 2025, Mr. Warren Buffett sounds much like his father. Below is a direct quote from his letter.

“Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge. Fixed-coupon bonds provide no protection against runaway currency.” (2025, Buffett, W.)

Both quotes are strikingly similar and argue for fiscal restraint and responsibility from the U.S. government. Government debt was high post-WWII and indeed is high again in 2025. The gold standard was never to be reinstated, and the gold-exchange standard lasted until 1971. The solution post-WWII was for a dose of austerity combined with programs to grow our economy and financial repression in the bond market. I fear the challenge we face in 2025 will be much harder than that in 1948, but not impossible! I always find Buffett very upbeat, so let’s echo Buffett in our words and actions!

Buffett’s Asset Allocation

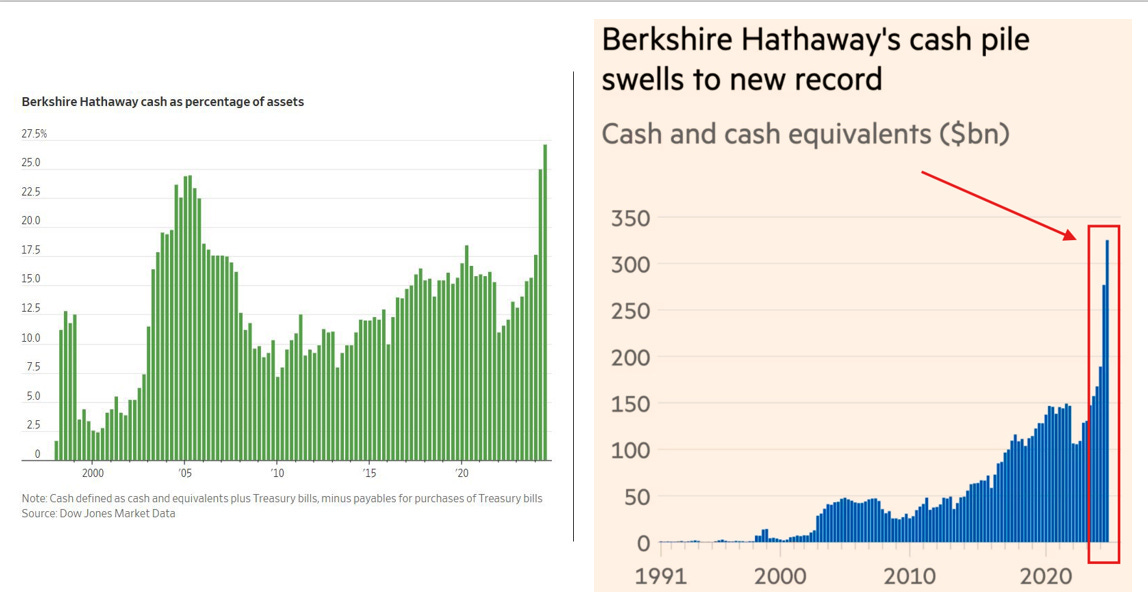

Buffett has always been a strong proponent of investing in stocks. He entered his career at almost the perfect time to become an equity investor and has made the most of this opportunity and more. I agree wholeheartedly that many portfolios should have a healthy allocation to long-term equities in quality companies. This has proven to be one of the best ways to grow wealth. However, don’t be fooled; he has mountains of cash invested in short-dated US Treasury Bills, paying 4%+ coupons (see figure 1 below). But the bulk of his assets remain in stocks. As he stated in his letter:

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change. While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio.” (2025, Buffett, W.)

Figure 1: Buffett’s Cash Balance

Source: Simplevisor

His cash position increased mainly because he reduced his stake in public equities instead of privately held companies. One example of a private company he owns is GEICO. This build-up of cash indicates that US stocks are overvalued compared to historical standards and have had a tremendous run since 2009. Also, for exposure to fixed income/bonds, the short end of the market is attractive for a portion of portfolio allocations. Buffett doesn’t mind earning 4-5% in short-term Treasury Bills as he waits for better opportunities in the public markets. Buffett added that current investment opportunities are getting harder to find:

“We are impartial in our choice of equity vehicles, investing in either variety based upon where we can best deploy your (and my family’s) savings. Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities.” (2025, Buffett, W.)

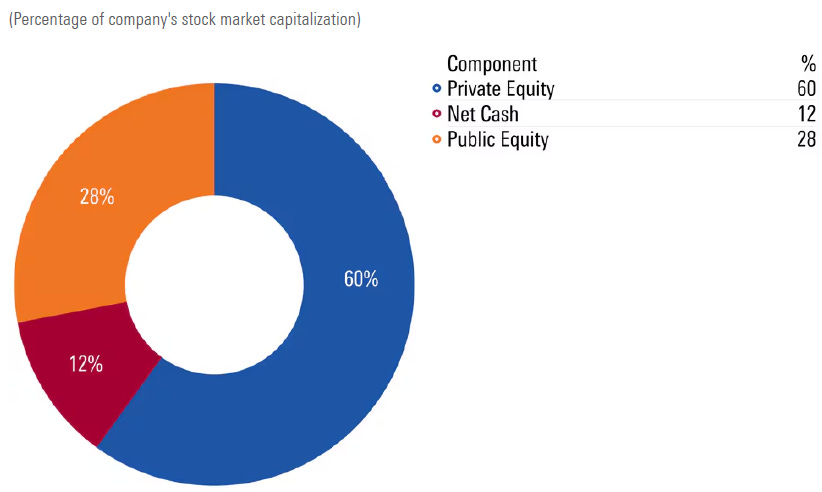

John Rekenthaler at Morningstar pointed out an interesting fact: Buffett’s portfolio is mostly invested in private companies, with 60% of it being in what he calls non-marketable companies. Another term for this is “private equity.”

Figure 2: Berkshire Hathaway’s Asset Allocation

Source: Morningstar

Buffett also discussed property and casualty insurance, which is near and dear to my heart as a P&C insurance agency owner. He discussed insurance companies' tremendous advantage if managed appropriately, as they take in revenue first and pay expenses later if a significant event occurs (hurricane, fire, etc.). Reinsurance is a profitable “carry trade” if managed appropriately with small amounts of leverage. Again, don’t be fooled; running an insurance company profitably is not easy. Ask the dozen who have gone out of business in Florida over the past few years.

I greatly respect Mr. Buffett, and his track record is unbelievable. Sure, he’s had many good opportunities, but he had to prove himself to earn them. He will undoubtedly go down as one of the best investors in history.

Market Action

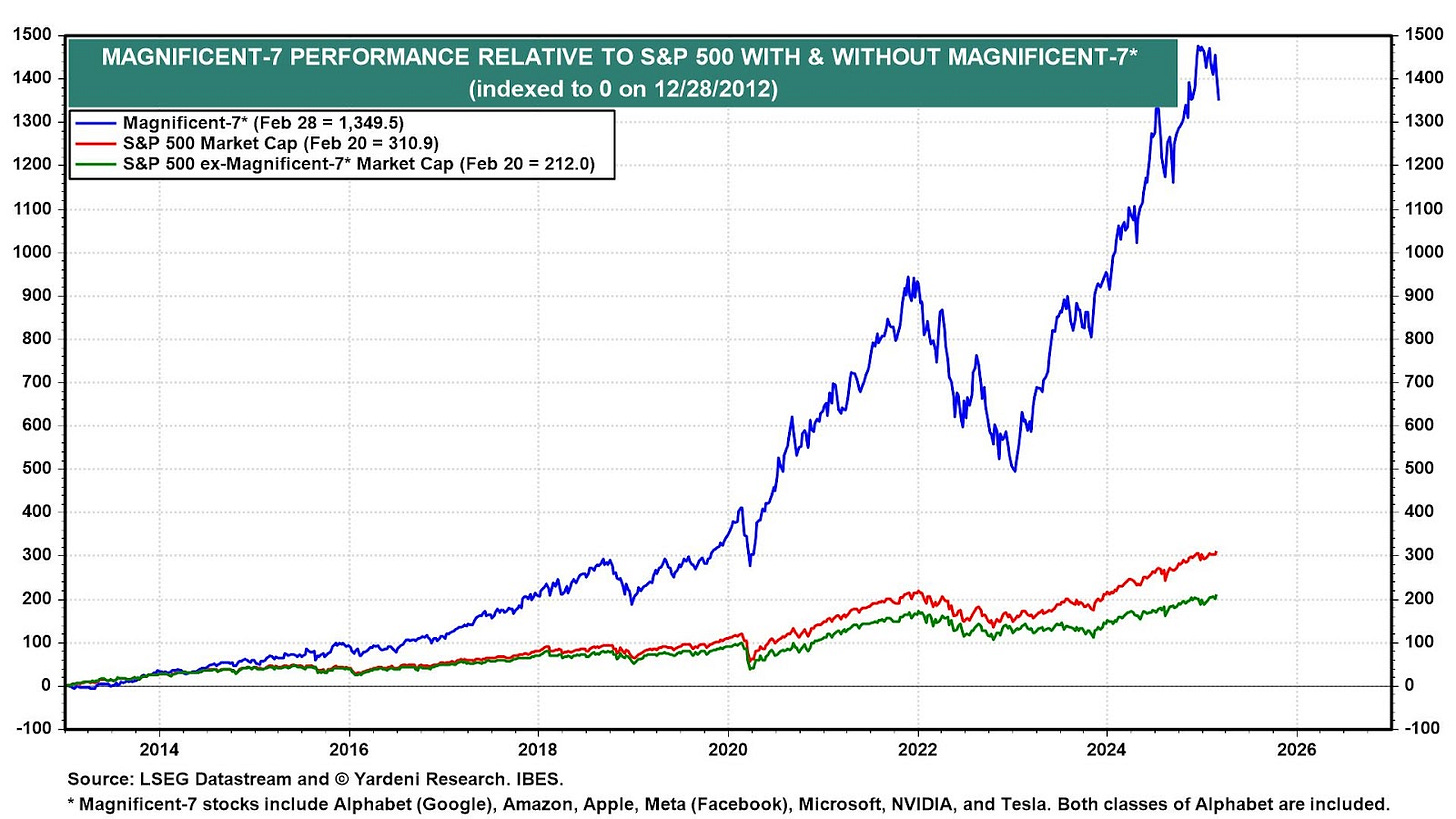

Just a few brief notes on the markets. US stocks remain slightly positive this year, with the “Magnificent Seven” rolling over a bit, causing some volatility. This cohort of stocks has led the charge (Figure 3 below). With a new administration going to work on our fiscal issues, remember this is austerity. One man’s spending is another man’s income. The less spending, the less income, and the less economic growth. The most recent GDPNow estimate from the Atlanta Fed now forecasts a drop of 3% in GDP growth, which corroborates recent market action.

Figure 3: Mag 7 vs. The Rest of S&P 500

Source: Yardeni Reserach

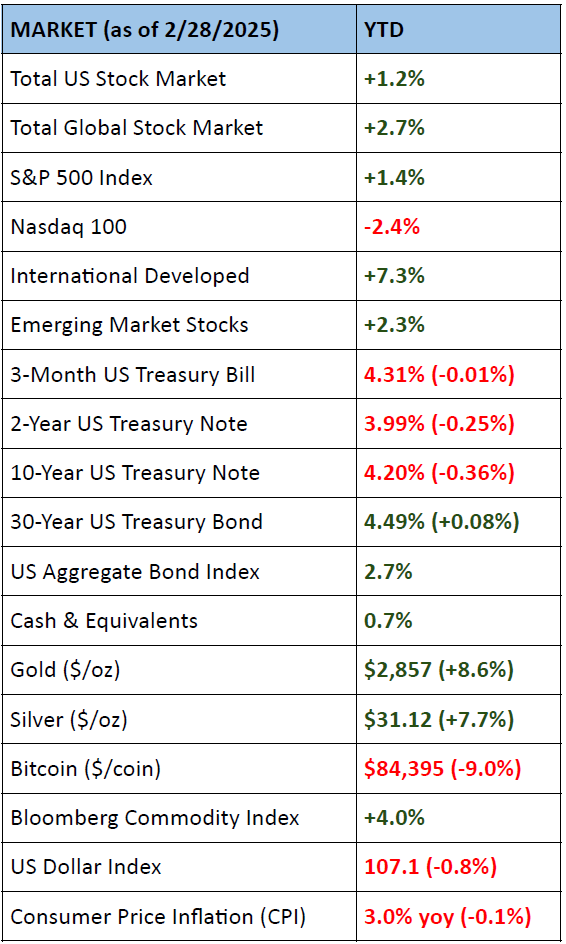

International stocks are up nicely this year, primarily due to European strength. The 10-year US Treasury bond has dropped and is aiming for 4%. With $10 trillion in debt to roll over, this would be a welcome sign for Scott Bessent in his new role as Treasury Secretary. Gold continues to shine, beating most assets so far this year. The entire commodity market is up 4%, reversing a trend from last year. Two months is very short-term, so we’ll have to see how the rest of the year plays out. I foresee choppy markets ahead with a very “headline-driven” market. Below is a table of the year-to-date performance of the major asset classes.

Sources: Kwanti Portfolio Analytics, TradingView

Quote of the Month

“Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere. But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.”

Howard Buffett, 1948

References

- Buffett, H. (1948). Human Freedom Rests on Gold Redeemable Money. The Commercial and Financial Chronicle.

- Buffett, W. (2024). BERKSHIRE HATHAWAY INC. Annual Shareholder Letter 2024. https://www.berkshirehathaway.com/letters/letters.html

- Atlanta, F. R. B. of. (2025). GDPNow. https://www.atlantafed.org/cqer/research/gdpnow

- Rekenthaler, J. (2024). Berkshire Hathaway: A Mutual Fund in Disguise?

- Simplevisor

- Yardeni Research

- Kwanti Portfolio Analytics

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS