Market Brief - December 2024

Posted:December 5, 2024

Categories: Markets, Stock Market, Market Update, Asset Allocation, Commentary, Commodities, Gold, Money, Stocks, US Dollar, US Treasuries

“No, no, he didn't slam you, he didn't bump you, he didn't nudge you... he *rubbed* you. And rubbin, son, is racin” Robert Duvall as Harry Hogge in Days of Thunder

My boys and I have been on a Tom Cruise movie kick recently. This quote from Days of Thunder is one I remember from when I watched it earlier in life. In the movie, Cruise plays an up-and-coming NASCAR driver named Cole Trickle. During his first few races, the top driver of the circuit, Rowdy Burns, would routinely bump Cruise to get inside his head. The crew chief, played by the great Robert Duvall, reminded Cruise that he wasn’t being hit, just “rubbed.” Cruise had to learn to deal with the pressures of driving NASCAR and how to succeed.

Naturally, I thought of geopolitics and the global monetary system when hearing this quote again. As I survey the economic and political landscape after the Trump victory, I see many countries preparing for a bumpy ride over the next few years. After a long period of globalization since roughly the mid-1990s, many countries are jockeying for their position in the global monetary system. Will our current system continue, or will countries pursue a protectionist and mercantilist system away from globalization? Only time will tell. For now, let’s turn to markets.

Stocks

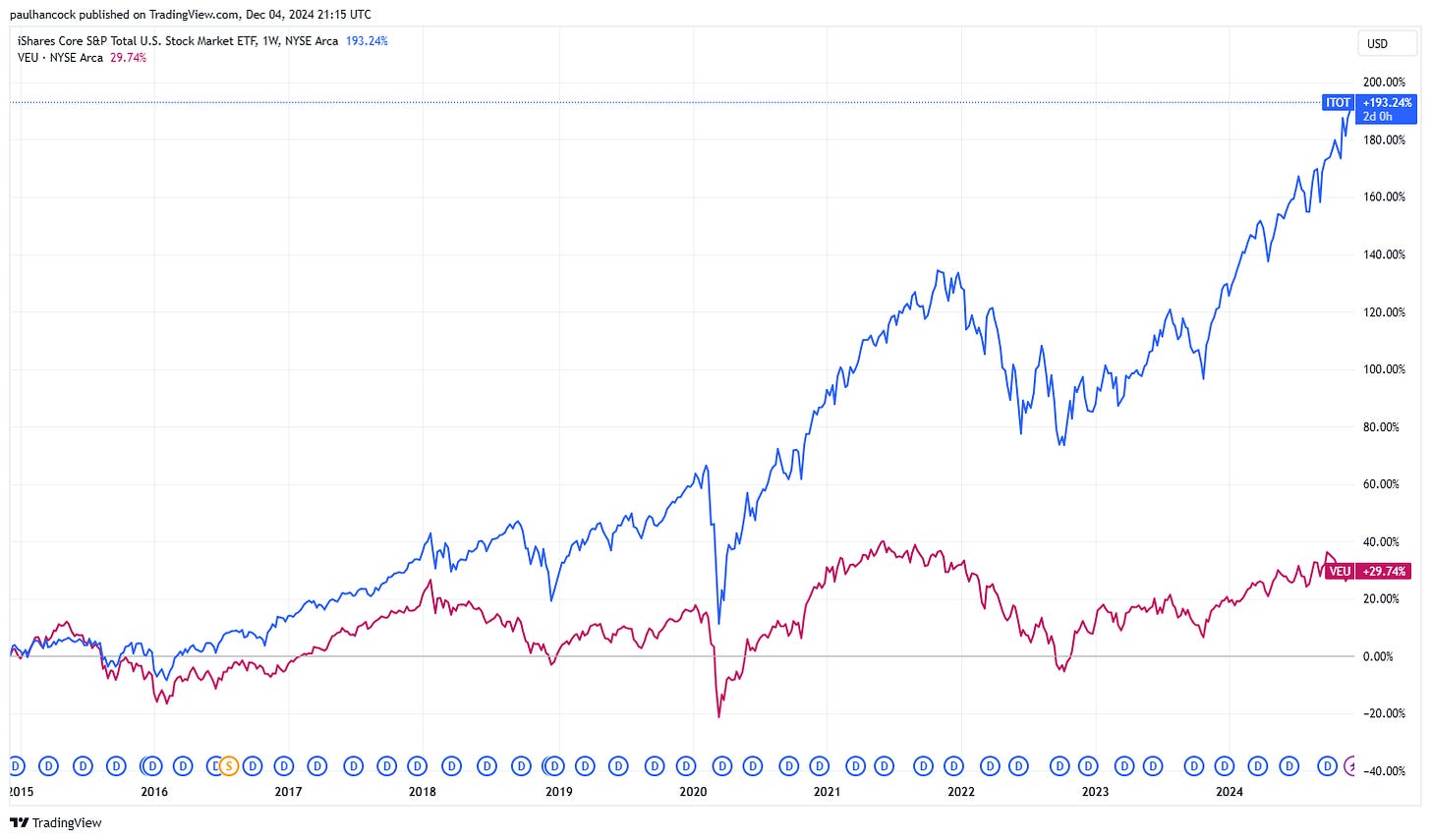

The stock market continues to perform well post-Trump victory and is on pace for one of the best years in its history. Trump’s promises have been net positive for “animal spirits” and stocks. The divergence between returns in and outside the United States continues to grow. The big question is how long will this outperformance continue (see Figure 1). By any measure of valuation, stocks in the United States have looked stretched for some time now. However, I’ve learned that cheap markets can get cheaper, and expensive markets can stay expensive for longer than most investors can imagine. Furthermore, global investors have flooded the United States with capital for years, aiding stocks.

Figure 1: US Stocks (blue line) vs. Non-US Stocks (purple line) 10-years

Source: TradingView

Bonds

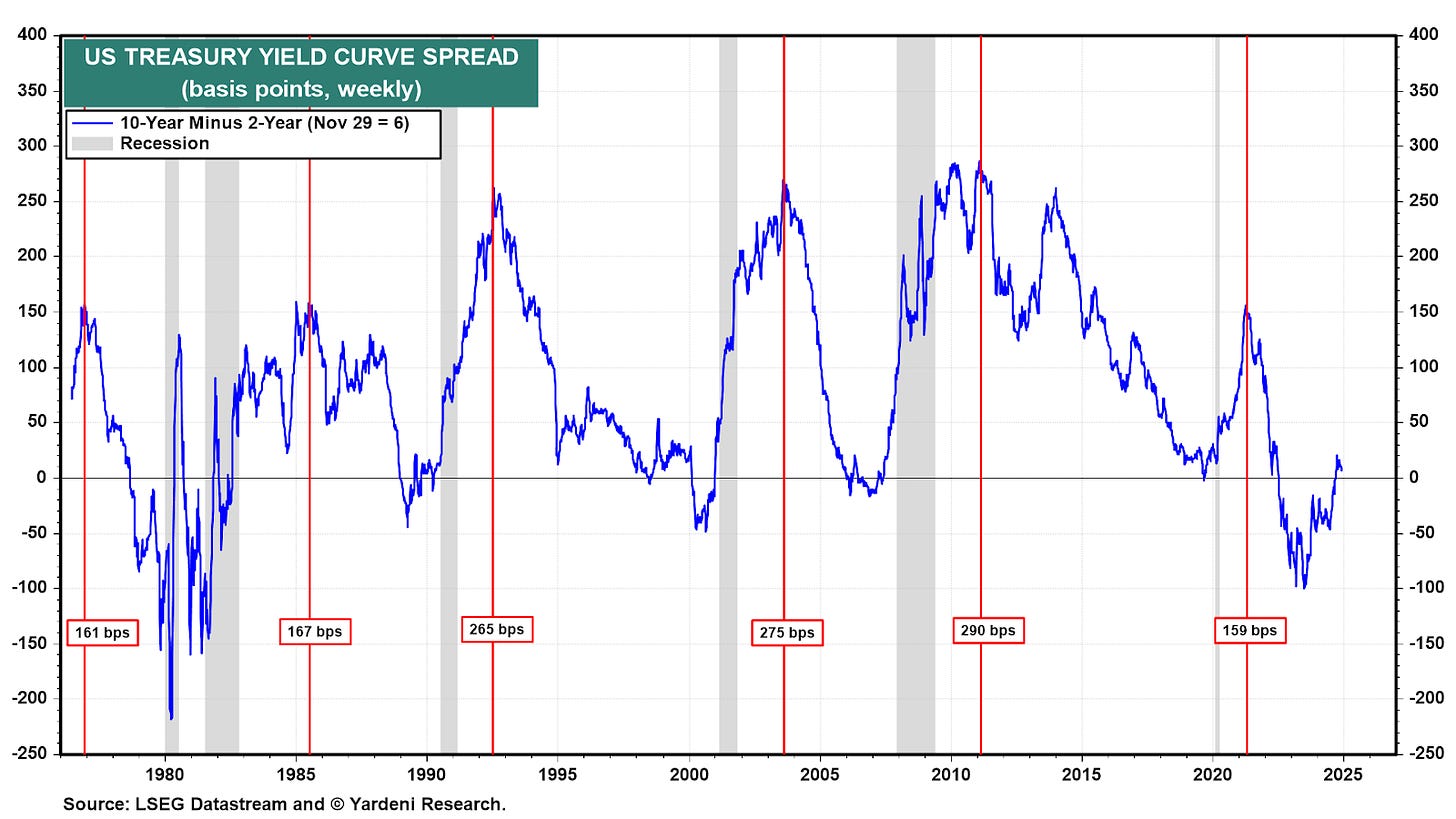

US Treasury rates dropped during the month, and the yield curve remains slightly inverted. The benchmark 10-year bond ended the month at 4.18% vs 4.50% for the 3-month bill and 4.16% for the 2-year note. To be clear, this is still not a normal situation. In a normal market environment, the yield that investors obtain for a 3-month instrument should be lower than that of a 10-year bond. After all, the risk is much lower investing in a 3-month Treasury bill vs. a 10-year Treasury bond. Again, markets can stay abnormal longer than most assume. I argue that the US Treasury has suppressed longer-term yields by issuing more short-dated bills to satisfy global demand for liquid, short-term safe assets. From my vantage point, a 4% plus risk-free rate with low duration remains attractive. Duration can be added or increased as market conditions and rates warrant.

Figure 2: US Treasury Yield Curve Spread (10-Year Minus 2-Year)

Source: Yardeni Research

US Dollar

The dollar continues to strengthen on the back of the election. Many feel Trump’s policies will be positive for the dollar. I’ve also heard many feel the dollar will lose market share over the coming years due to the mountain of federal debt. In reality, it’s very hard to know the path forward. You might see the dollar strengthening against some currencies and weakening against other currencies based on how Trump & company pursue trade policies.

Commodities

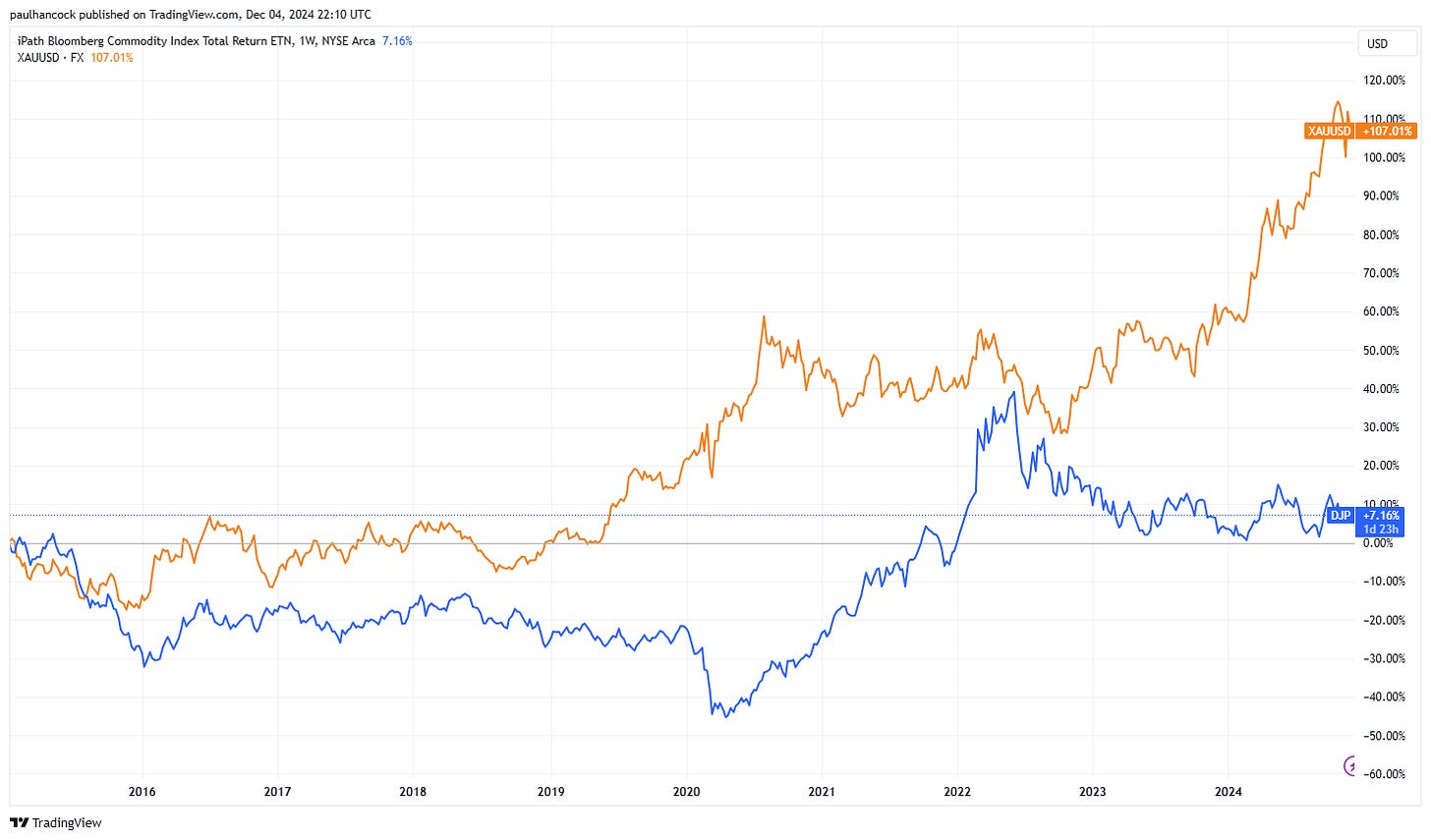

Commodities outside precious metals are one market that has languished. Below is a 10-year chart of the Bloomberg Commodity Index (blue line) and gold (orange line). A healthy amount of monetary inflation and lower oil prices explain some of this divergence. Further, a strong US dollar is a net negative for commodity prices. However, if “high street” inflation returns as it did post-COVID, you may see the index catch up to gold in terms of performance. Commodities are inherently cyclical.

Figure 3: Commodities & Gold (10-Year)

Source: TradingView

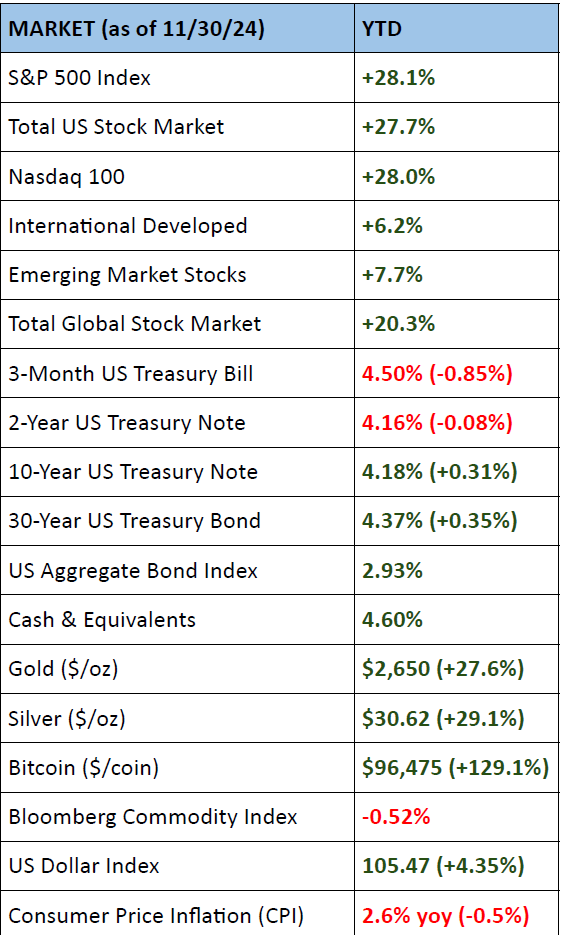

Markets

Sources: Kwanti Portfolio Analytics, TradingView

Quote of the Month

“No, no, he didn't slam you, he didn't bump you, he didn't nudge you... he *rubbed* you. And rubbin, son, is racin” Robert Duvall as Harry Hogge in Days of Thunder

References

- Yardeni Research

- Kwanti Portfolio Analytics

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS