Made in China - Part II

Posted:October 31, 2024

Categories: China, Central Bank, Currencies, Gold, Monetary Policy

Following the actions of the United States Federal Reserve and the People’s Bank of China (PBoC) is paramount for investors in today’s markets. The US and Chinese economies account for roughly 43% of the world’s GDP (income). The actions of each central bank have dramatic effects on economic growth and financial markets. I believe the issues occurring within the Chinese economy pose a major risk to the global economy and financial markets over the next few years.

In my last article on China, I laid out three potential paths for the PBoC to aid in the economic recovery of China. Those options were to:

- Devalue the Chinese Yuan currency relative to the US Dollar.

- Deflate and allow their economy to suffer and continue its deflationary decline.

- Do Nothing and keep the Chinese Yuan currency fixed to the US Dollar.

It didn’t take long to see the first indications of the path forward for the PBoC. The path chosen so far is something close to #3 above but with some good old Keynesian economic policies. In late September China announced a large stimulus package for its ailing economy. While the measures may “look huge,” the actions will likely fall short of stimulating long-term economic growth. Despite this, the stock market soared, hitting levels not seen for 2 1/2 years. Given the nature of the State-owned financial system, it can be difficult to make sense of their projections. According to reports they plan to reduce interest rates in the banking system, reduce mortgage rates for existing loans, and cut down payment requirements for new loans. All told, this is estimated to release about 1 trillion yuan (~ $140 billion) of liquidity into their financial system. Compare this to the United States' response during the Global Financial Crisis (“GFC”) in 2007/08 when the Fed infused $2 to $3 trillion into the US financial system. Compared to China, you’re talking 15-20 times less. Instead, what China needs is more money creation and liquidity.

Red Capitalism

The term “red capitalism” refers to the economic model adopted by China upon admittance into the World Trade Organization (WTO) in 2001. Essentially, this involved overproducing cheap goods and selling them to Western economies in return for dollars. China recycled the majority of these dollars into US Treasury government bonds. This model broke down in 2008 around the Global Financial Crisis (GFC). Michael Howell points out in his book Capital Wars that China was a “trigger” in the GFC noting:

“Closer inspection of capital flow and credit data highlight the People’s Bank (PBoC) tightening Chinese credit conditions in early 2008, probably to defray industrial pollution concerns and improve air quality ahead of the showcase August 2008 Beijing Olympics. This forced credit-starved Chinese borrowers into the offshore Eurodollar markets in search of replacement funding. Could their demands have simultaneously clashed with the rising needs from Western borrowers, who were increasingly struggling to finance their leveraged mortgage-backed and asset-backed portfolios, particularly the failure of Bear Stears?”

After the GFC and with less demand for goods from Western consumers, China shifted its focus to financing large infrastructure and real estate spending to spur economic growth. Most of this was fueled by credit (debt) pumped in by the State and doled out by State-owned banks. As discussed before, this worked until it didn’t. We’re now at a turning point where Western demand is waning, tariffs are increasing, and debt-fueled growth is slowing.

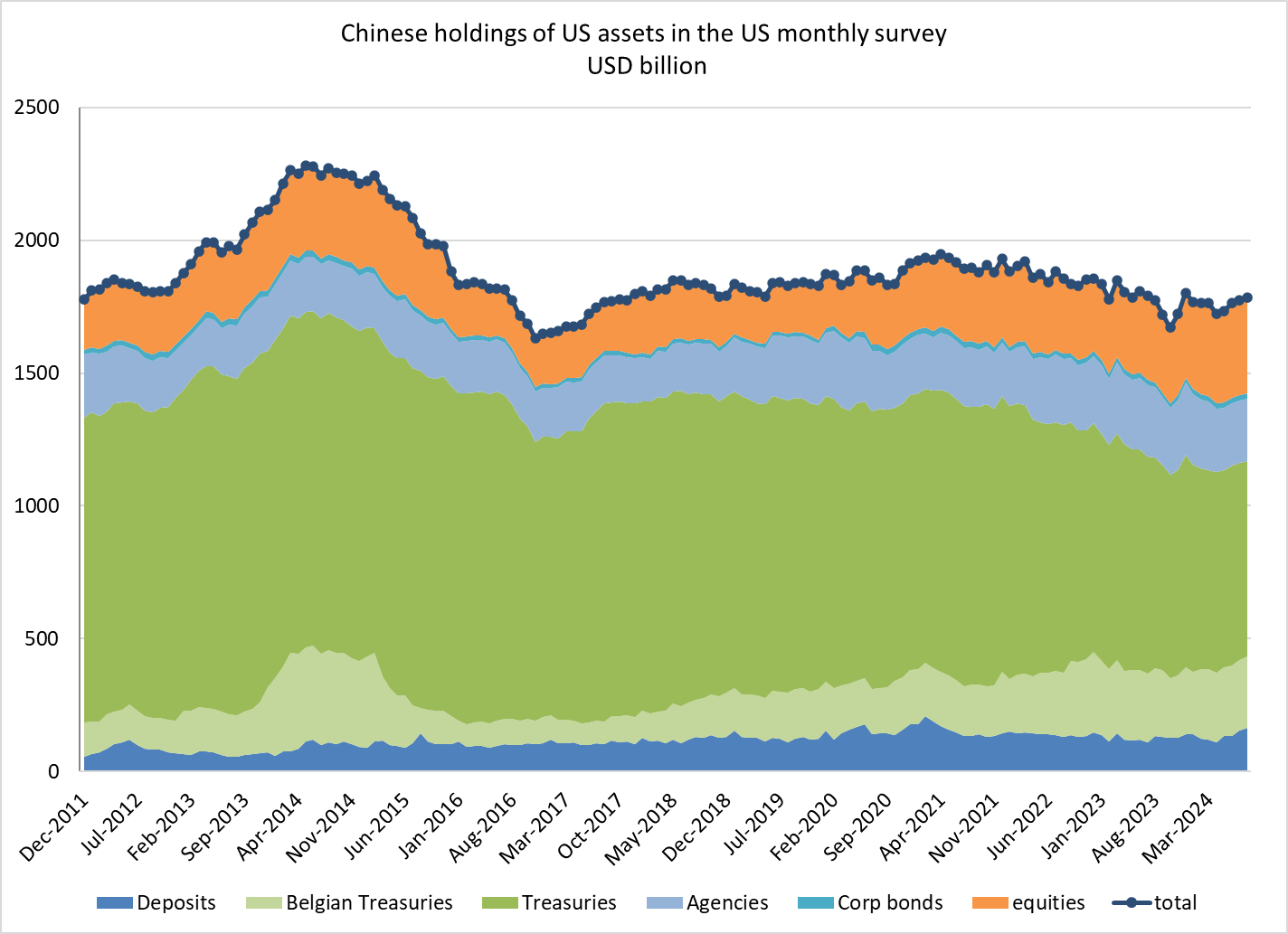

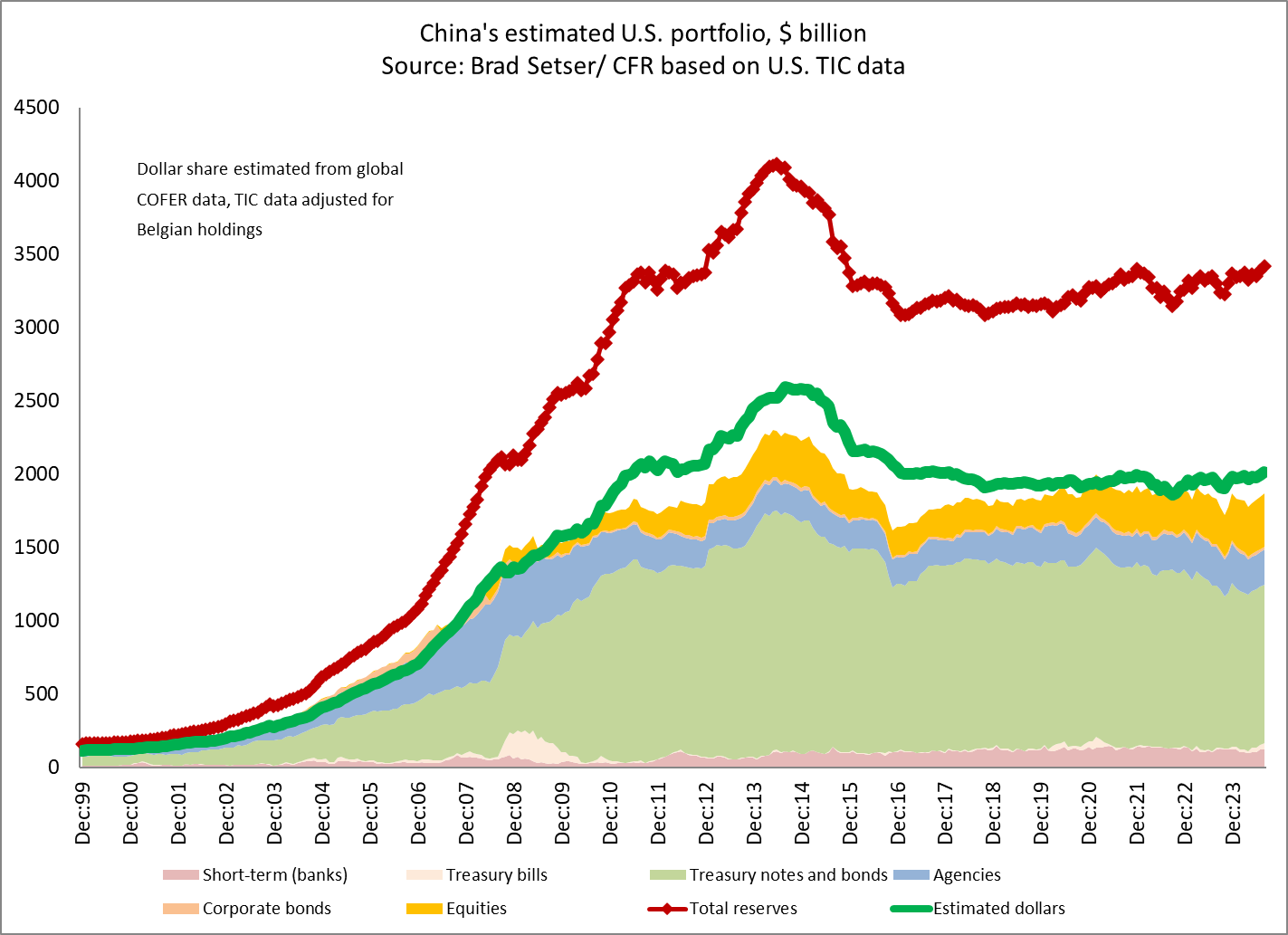

Exchange Rate Wars

The recent actions announced by the PBoC will not solve the problem as much of the 1 trillion yuan package will be funded from current savings, not new money. China needs monetary stimulus which will be much more powerful than interest rate cuts. This is a similar issue that faced Japan in the 1980s, Sweden in the early 1990s, and Asian countries in the late 1990s. The bottom line is that China is a dollarized market. Their banks have huge dollar assets and liabilities. The dollar also remains the main clearing currency for exports and imports. As seen in Figures 1 & 2 below China holds roughly $2 trillion in US assets. Contrary to reports, their US assets have remained relatively stable since 2011.

Figure 1: Chinese Holdings of U.S. Assets

Source: @Bred_Setser via X

Figure 2: China’s Estimated U.S. Portfolio, $ Billion

Source: @Bred_Setser via X

We’ve already discussed that China is refusing to allow deflation to take hold. Like the United States, China also has a debt-based monetary system. A deflationary economy is one of falling inflation, falling asset prices, and lower wage growth. This is a recipe for disaster in a country starved for economic growth. As I’ve argued, China must allow its exchange rate to fall vs. the US dollar in the long run. As a reminder, China keeps its currency “pegged” in a range vs. the US dollar. In other words, their government manipulates the currency not to move up or down against the dollar outside a certain trading range. This is all well and good when an economy is small and emerging. China is neither small nor emerging at this point. Allowing the currency to devalue could be a release valve for their economy.

Why won’t China allow its currency to adjust downward?

- China is eager to supplant the US dollar in trade and is using the Yuan as a weapon of “soft power.” A strong yuan is an attractive vehicle for increased trade. For example, China would prefer to use the Yuan as a trading currency for oil and other commodities. The problem is the recipient of the yuan, such as Saudi Arabia, doesn’t have as much flexibility to spend the yuan vs. the US dollar. Per reports, the yuan’s share of global trade settlements is only 3% vs. the dollar at 84%. Even the Euro is higher at 6%.

- A strong yuan is key to its “Belt and Road Initiative.” A large-scale strategy of buying up infrastructure assets linking East Asia to Europe similar to the “Silk Road” years ago. This is a strategy modeled after what the United States uses through the IMF and World Bank, created under the Bretton Woods System in 1944, to increase its power and resources across the globe. As a member of the BRICS initiative (explained below), they have been pushing for the creation of the New Development Bank (NBD) which is similar to the current World Bank and the Contingent Reserve Arrangement (CRA) similar to the International Monetary Fund.

- China wants to grow its bond market. A strong and stable currency is key for other countries to own yuan-denominated debt. Further, a true “reserve currency” must have a deep and liquid bond market. Demand for yuan-denominated bonds is virtually non-existent.

BRICS

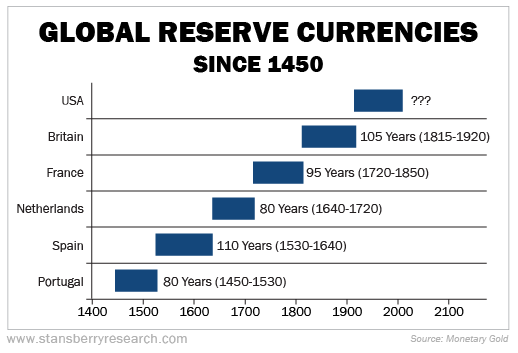

Reserve currencies last a long time, usually a century or longer. China’s goal of supplanting the US dollar is a difficult one. An alternative solution might be through the “BRICS” initiative possibly involving some type of new trade currency and some type of gold backing and/or net settlement vehicle. This would, however, require China to “play nicely” with many other nations. Specifically, nations that have signed up for the “BRICS” initiative. “BRICS” is short for Brazil, Russia, India, China, and South Africa. This consortium of countries along with some “friends” have stated goals such as coordinating economic policy, reducing reliance on the US dollar, and creating an alternative payment/finance system.

Figure 3: Global Reserve Currencies Since 1450

Source: TalkMarkets

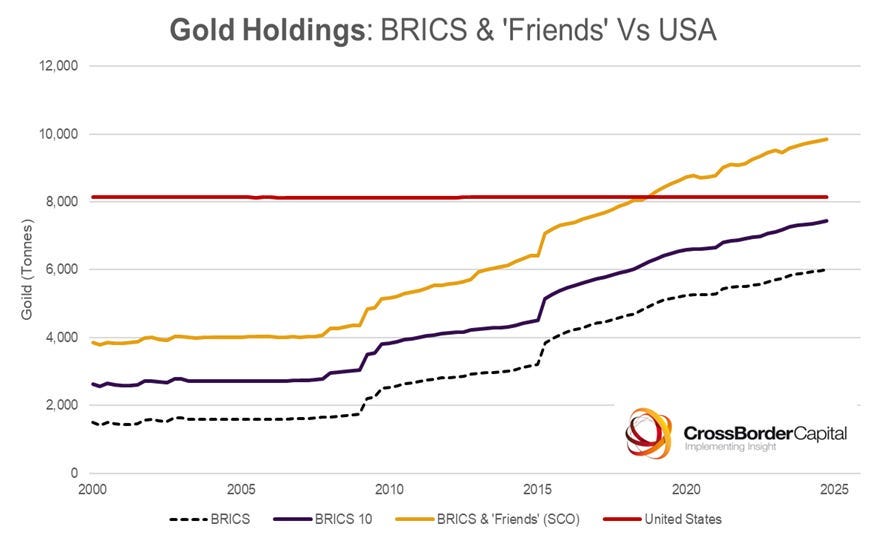

So far, not much concrete has been done through this initiative. A major focus of this group also appears to be the utilization of gold in some type of cross-border payment/monetary system. If true, and if they can work together, this could be a stealth threat to the dominance of the US dollar. As seen in Figure 4, this group now holds 25% of central bank gold bullion in reserve. While the yuan remains in a tight range relative to the dollar, it has depreciated 80% vs gold in the past 5 years.

Figure 4: BRICS Gold Holdings

Source: CrossBorder Capital

The Path Forward

The main risk China poses to the global economy is not through the BRICS initiative, but rather its insistent demand for dollars. While China and its friends can say they want to “de-dollarize,” it’s not easy. The global economy lives on the US dollar, at least for the foreseeable future. After the Bretton Woods Agreement in 1944, the dollar was pegged to gold, while other fiat currencies were pegged to the dollar. Post 1971, currencies have freely floated against one another. This has created a “relative” battle in fiat vs. fiat. The US dollar has emerged victorious so far. Most economic crashes since the 1990s have coincided with a shortage of dollars to fuel an ever-growing pile of dollar-denominated debt. Liquidity is king in the 21st century.

References

- Howell, M. (2020). Capital Wars: The Rise of Global Liquidity (2020). [Print]. Springer.

- Setser, B. (2023, October 3). China Isn’t Shifting Away From the Dollar or Dollar Bonds. Follow the Money and Greenberg Center for Geoeconomic Studies. https://www.cfr.org/blog/china-isnt-shifting-away-dollar-or-dollar-bonds

- Hamid, J. (2024, September 17). China’s yuan will never replace America’s dollar. Jai Hamid. https://www.cryptopolitan.com/china-yuan-will-never-replace-america-dollar/

- Howell, M. (2024, October 21). Capital War! Capital Wars.

DISCLOSURES & INDEX DESCRIPTIONS