Leaders During an Age of Debt

Posted:July 18, 2024

Categories:

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.” G. Michael Hopf, Those Who Remain

This quote resonated in my mind after the assassination attempt on former President Trump's life. The United States, over the past 20+ years, has been experiencing a season of “weak men (and women) create hard times”. We find ourselves amid a “Fourth Turning” in the West, where decadence reigns supreme. Nations rise and fall, and decadence is their downfall. Yet even while we are deep in the Winter Season, one should always look for hope to creep up through the snow towards the future. We need the strongest leaders we can summon to survive this tumultuous time in our country’s history. Nations need strong leaders.

Without a doubt, we are living in an Age of Debt. Some argue that this Age began in 1694 when the Bank of England, a central bank, was founded. Or in 1913 when the United States central bank, the Federal Reserve, was created. Some believe it began in 1971 when President Nixon officially took the United States off the gold standard. In his book, The Asian Financial Crisis, Russell Napier argues that in the late 1990s, the Age of Debt began.

“Give me control of a nation’s money supply, and I care not who makes its laws.” Mayer Amschel Rothschild (1743 - 1812).

With the Bank of England as its guide during the early 20th century, the Rothschild family helped John Piermont “JP” Morgan, our nation’s commercial banks, and our politicians in the United States create the Federal Reserve Bank.

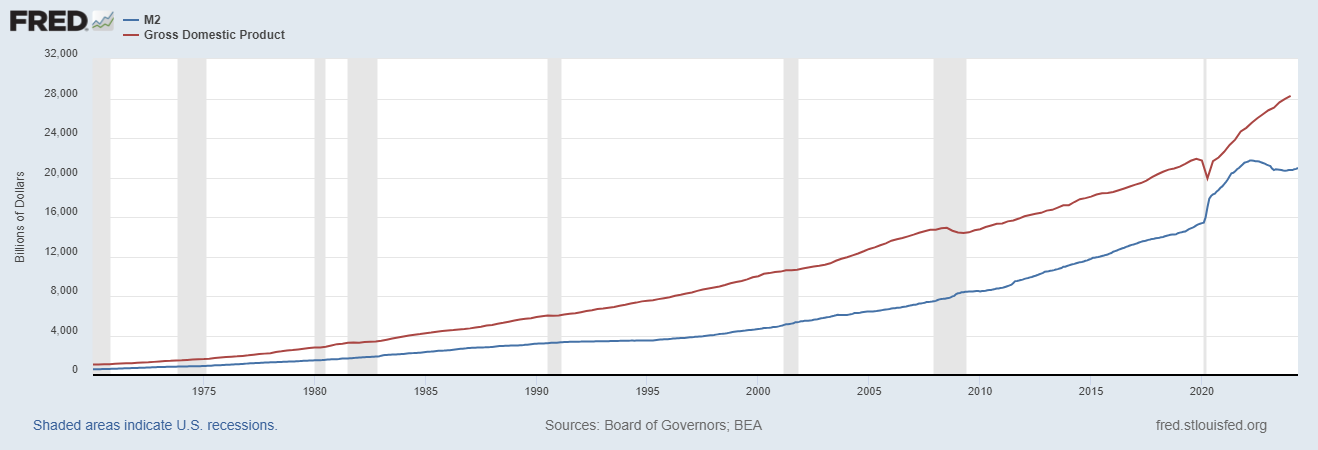

Unfortunately, Amschel Rothschild was right about a nation’s money supply. The evidence is plain to see in the chart below. This chart plots the money supply growth (blue line) with the US Gross Domestic Product (red line) since 1970. As a reminder:

GDP = Income of the United States

M2 = Money Supply (currency in circulation, reserves, deposit accounts, etc.)

The creation of money and credit has powered our economy to unimaginable heights, for good and for ill. Pay close attention to how the money supply rose during the last two recessions; the global financial crisis of 2007-09 and during COVID in 2020. Nothing slows this down.

Figure 1: M2 + GDP since 1970

Source: Federal Reserve Bank of St. Louis (FRED)

With US public debt hitting $35 trillion and total global debt at $315 trillion, the world needs leaders to manage this heavy debt burden. All nations cannot default at the same time. Neither can all nations magically go back on the gold standard. The situation is much more complex. Our world is becoming polarized, a classic “fourth turning” trait. As winter turns to spring, as the present becomes the future, we approach the end of the Fourth Turn and round into a new First Turn. Now more than ever, America needs strong men and women leading our country, leading our nation through this time of heavy debt burden.

References

- Hopf, G. M. (2016). Those who remain: A Postapocalyptic Novel. G. Michael Hopf.

- Napier, R. (2021). The Asian Financial Crisis 1995–98: Birth of the Age of Debt. Harriman House Limited.

- Howe, N. (2023). The fourth turning is here: What the Seasons of History Tell Us about How and When This Crisis Will End. Simon and Schuster.

- U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP, July 17, 2024.

DISCLOSURES & INDEX DESCRIPTIONS

For disclosures and index definitions please click here.

Opinions expressed herein are solely those of Genesis Wealth Planning, LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. Written content is for information purposes only. Past performance is no guarantee of future results. Diversification does not assure profit or protect against a loss in a declining market. While we have gathered this information from sources believed to be reliable, we cannot guarantee the accuracy of the information provided. The views, opinions, and forecasts expressed in this commentary are as of the date indicated, are subject to change at any time, are not a guarantee of future results, do not represent or offer of any particular security, strategy, or investment, and should not be considered investment advice. Investors should consider the investment objectives, risks, and expenses of a mutual fund or exchange-traded fund carefully before investing. Furthermore, the investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their professional advisers if any of the investments mentioned herein are suitable to their personal goals. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not reflect fees or expenses. To receive a copy of Genesis Wealth Planning ADV Part II which contains additional disclosures, proxy voting policies, and privacy policy, please contact us. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.