History of Money - Stablecoins & Dollar Hegemony

Posted:November 14, 2024

Categories: Cryptocurrency, Bitcoin, Bonds, Central Bank, Credit, Currencies, Fiat Currency, US Treasuries

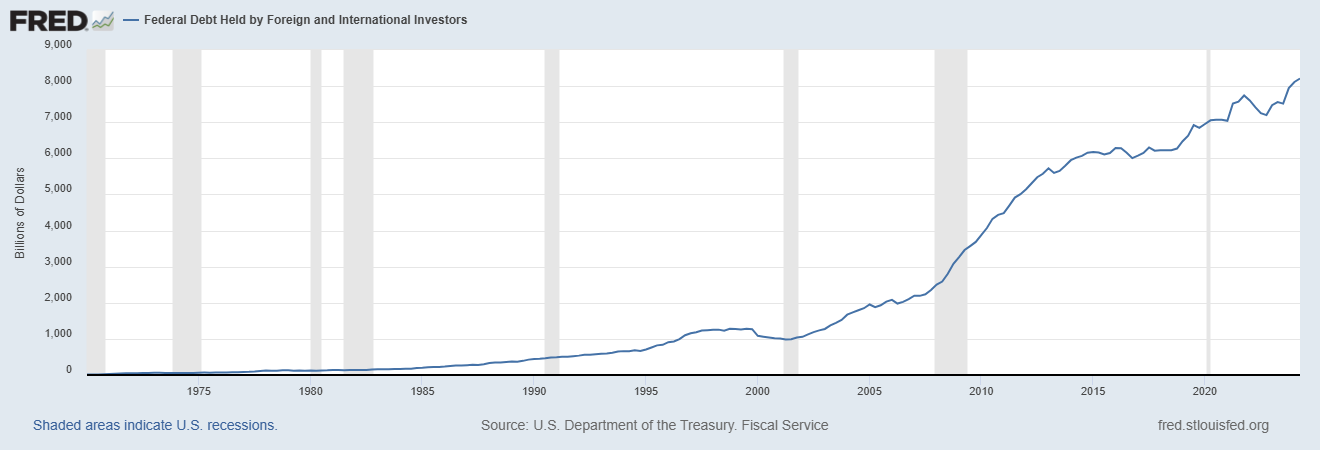

Since 1971, the US dollar’s role as the global reserve currency has exploded in size. Historically, economies have demanded what I call “safe assets.” Under the classic gold standard in the 19th and 20th centuries, gold was the premier global safe asset. Following the end of the Bretton Woods system designed in 1944, the US dollar and increasing the dollar in the form of US Treasury bonds (debt) has emerged as the premier global “safe asset.” The United States has continued running large current account deficits as demand for safe assets has only increased. This can clearly be seen below in Figure 1 as US federal debt held by foreigners has ballooned to 8.2 trillion dollars as of Q2, 2024. China entered the arena in the early 21st century as a glad recipient of dollars in exchange for cheap goods thereby exacerbating this system. The demand for the US dollar from large reserve managers and global institutions remains extremely large.

Figure 1: Federal Debt Held by Foreign and International Investors

Source: St. Louis Fed

Stablecoins were first created in 2014 as a layer on top of the Bitcoin network. Eventually, developers began to create stablecoins on separate blockchains. What emerged was a cryptocurrency whose value was “pegged” to other asset classes, primary US dollars. Inflation rates are high in many developing countries such as Argentina (200%), Venezuela (59%), Turkey (50%), Zimbabwe (35%), and on and on. It’s hard for Americans to imagine this type of monetary system. We are so used to stable inflation that anything above 5% is considered the end of the world for US consumers. Yet people in countries with massive inflation don’t have a choice for their eroding purchasing power…until now. Enter Stablecoins.

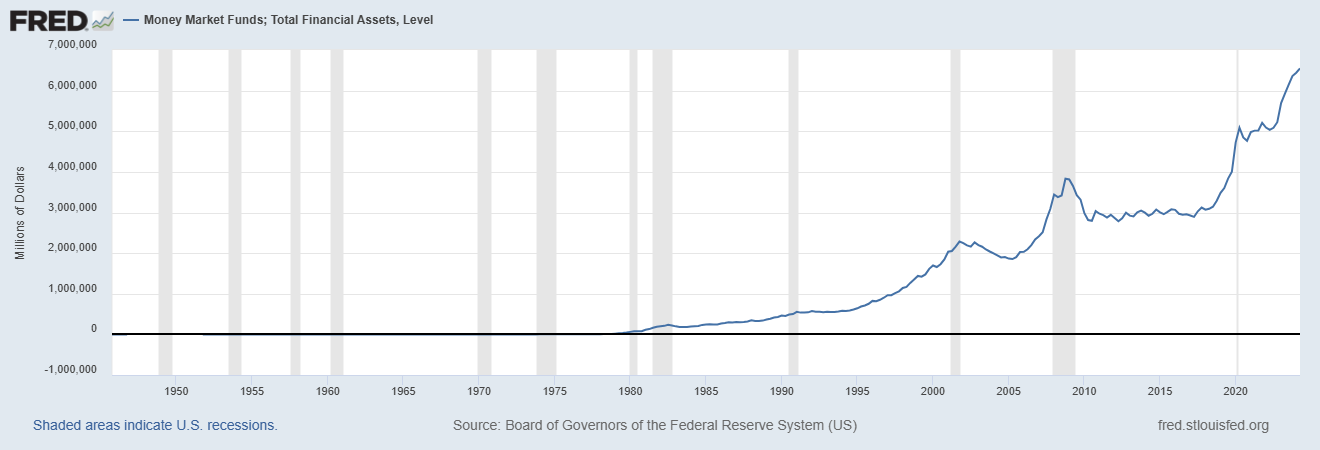

The Emerging Consumers Money Market Fund

Many Americans are used to money market mutual funds. Virtually every commercial bank and large custodian has money market funds. Figure 2 below shows the level of money market assets has risen to $6.5 trillion as of Q2, 2024. Money market funds are instruments designed to hold safe assets and keep their Net Asset Value (NAV) at a fixed $1.00 per share. Issuers of these funds tend to hold assets in very liquid safe instruments such as short-term US Treasury bills and commercial paper. Investors earn higher interest rates in these vehicles without sacrificing risk.

Figure 2: Money Market Funds; Total Financial Assets

Source: St. Louis Fed

Stablecoins essentially mimic a money market fund with one large exception. The end recipient of the stablecoin generally earns zero interest. This type of asset has little appeal to Americans and global citizens who have access to safe, interest-bearing assets and fiat currencies (Dollars, Euros, Pounds, etc). However, imagine again you are a citizen of a country with high inflation and you want access to US dollars to protect your purchasing power. If your country forbids you from opening a US bank account or online account with a custodian like Schwab or Vanguard, you are locked out of the system. This doesn’t seem fair. After all, most governments of these countries have access to US dollars through their reserve balance sheets, so why should they deprive their citizens of this access? Stablecoins look much more attractive as a savings vehicle to people in these countries relative to their inflated local currencies.

The Rise of Tether

Let’s look at an example of how stablecoins work. An individual or entity opens an account generally on their phone or computer with a stablecoin issuer. They then send fiat currency to the stablecoin issuer from the legacy banking system. The stablecoin issuer then creates a stablecoin token in the same amount minus fees. The recipient of the new stablecoin holds their tokens in a digital wallet and is free to use them for savings, trading, commerce, payments, etc. The stablecoin issuer now has a liability much like a traditional bank in the legacy banking system. The stablecoin holder can send their token back to the issuer at any time and receive 1-to-1 fiat currency in exchange for their token. If this occurs, the issuer of the Stablecoin destroys the coin.

Created in 2014, Tether has emerged as the largest issuer of stablecoins. Their business is remarkable. As of September 30, 2024, entities held $119.4 billion in Tether tokens. Tether held assets to back these tokens of $125.5 billion. In other words, their liabilities were fully backed. Of the $125.5 billion in assets, Tether held a whopping $84.5 billion in US Treasury bills maturing in 90 days or less. Further, they held another $20.7 billion in dollar assets such as reverse repurchase agreements, money market funds, and cash. This amounts to $105 billion in dollar assets. As mentioned above, the recipient of the tokens does not earn any of this interest. Rather, the recipient gets access to a non-interest-bearing US dollar via their Tether stablecoin. This is no different than that person holding a physical $100 bill and stuffing it under their mattress. Instead, they are doing the same activity, but “stuffing it digitally” on their cell phone.

This enables Tether to collect the entire amount of interest on US assets. With US Treasury bills yielding 4-5% annually, this amounted to $6.2 billion in profit for Tether in 2023. With an estimated 100 employees, this amounts to a remarkable $62 million in profit per employee. For context, Microsoft’s profit per employee was $329,000 in 2023. This seems like a great deal for all parties. The emerging consumer can hold US dollars via stablecoins thereby preserving their purchasing power. The issuer of the stablecoin earns a 4-5% risk-free rate of return. And the US federal government suddenly has a new demand source for its debt!

Demand for Safe Assets

The unending demand for global safe assets, primarily US dollars, seemingly has no end. From central banks to corporations like Microsoft, to Warren Buffett, to the emerging market consumer via Tether stablecoins, demand for US dollars remains robust. It’s no coincidence that interest rates on US Treasury securities fell steadily for 40+ years from the early 1980s until recently. Global savers sopped up US debt suppressing interest rates for years. While this has begun to unwind since 2022, the world still demands massive amounts of safe assets. Are there negative consequences the United States has as the issuer of the global reserve currency? In short, yes. Notably, Robert Triffin testified before Congress in 1960 that the United States would run into trouble being the issuer of the global reserve currency in the US dollar. He coined the phrase, “Triffin’s Dilemma.” Acting as the issuer of the global reserve currency requires the United States to run persistent current account deficits thereby creating more and more dollars to facilitate global international trade. Triffin was correct as the Bretton Woods agreement was severed in 1971. However, in a world of freely floating fiat currencies, the dollar emerged as a substitute for gold and the dominant global safe asset. Mathematically, this can’t go on forever. The United States can’t run endless deficits and pile up debt forever. At some point, confidence in the paper currency will erode as it did in the 1960s. This is one reason you’ve seen gold “re-emerge” to fill part of this demand for safe reserve assets. I see this as a continuing trend as confidence in the dollar has begun to wane on the margins.

Turning back to cryptocurrencies. With Bitcoin emerging as a clear winner from the US election, stablecoins have emerged as an incredibly useful tool for the emerging market consumer to access the US dollar. One of the main reasons many people buy Bitcoin and other cryptocurrencies is to flee the “evil dollar.” Ironically, one the largest and most successful cryptocurrencies to date, Tether, is essentially a mechanism to fund the US dollar and the US government through short-term US Treasury bills. Could stablecoins be a precursor to a Central Bank Digitial Currency? Only time will tell. But it does appear we are witnessing the beginnings of the future of global money in digital form.

References

- Federal Reserve Bank of St. Louis. (2024). Federal Debt Held by Foreign and International Investors [Dataset]. FRED. https://fred.stlouisfed.org/series/FDHBFIN#

- Federal Reserve Bank of St. Louis. (2024). Money Market Funds; Total Financial Assets, Level [Dataset]. FRED. https://fred.stlouisfed.org/series/MMMFFAQ027S#

- BDO Italia. (2024). Tether Holdings Limited Financial Report. BDO. https://assets.ctfassets.net/vyse88cgwfbl/5TKa7xwJVLIAnVBMWb7iTq/5688216da5194fce27f4a0f2e808a486/ISAE_3000R_-_Opinion_on_Tether_Consolidated_Financials_Figures_30.09.2024_.pdf

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS