History of Money - Introduction

Posted:August 15, 2024

Categories: Money, Gold, Fiat Currency, Markets

The history and study of money is one of the most complex topics in history. Dating back to the Bible, we see that money is mentioned in over 2,350 scripture verses. This is 7.5% of the entire Bible! The financial markets are full of commentators that debate the level of interest rates, the build-up of debt, inflation, deflation, the Federal Reserve, returns on stocks, bonds, paper currency, digital currency, gold, etc. Most Americans take money for granted. We live in an incredibly advanced society relative to historical standards. It wasn’t always this easy. Throughout time, money has enabled societies to advance quicker and faster through the division of labor. The creation of central banks and the disintermediation of money from gold and silver to fiat/paper currency has enabled greater power to form in the hands of few. The financialization of money since 1971 has further confused the definition of money. By looking back in time, we can learn so much about the history of money and what that means for our society today and the future.

This article is an introduction to a series of articles I plan to write about the history of money and monetary systems. I’ve worked in finance my entire career. From managing portfolios to analyzing the creditworthiness of businesses, to writing insurance on homes on Florida’s southwest coast. I’ve covered the entire balance and income statement. But it wasn’t until I studied the history of money and our monetary systems, that I fully grasped the true origins of money and how it relates to financial markets today.

Definition of Money

A common theme throughout these articles is the true definition of money. Originating from 1255 AD, Aristotle gives us the classical theory of money. Money serves as:

- Medium of Exchange

- Unit of Account

- Store of Value

- Means of Payment¹

Medium of Exchange

In a barter system, goods were exchanged directly between individuals. This is a theory called the “Double Coincidence of Wants.” For example, a farmer who held eggs would barter his eggs with the craftsmen who made shoes. As long as each party needs the other’s good, this system works. As civilizations and societies' financial systems advanced, the barter system broke down. Money eventually emerged in various forms to solve this issue. Money became a good that was not consumed but rather used as a medium of exchange between two parties. Each party held money in different forms such as seashells, stones, gold coins, silver coins, fiat currency, etc., and exchanged their money for goods or services they desired.

Unit of Account

Money must also be easily priced. Pricing goods and services in many different ways creates confusion and complexity. A single unit of account creates efficiencies for a medium of exchange. Through the age of time, gold emerged as the best form of money. Gold was defined by weight either in grams or troy ounces. With the advent of the Gold Standard in the early 1900s, the US Dollar (USD) was defined as gold measured at $20.67 per troy ounce. By 1934, gold was debased to $35.00 per troy ounce. It was eventually devalued to its current “official” price of $42.22 per troy ounce when Richard Nixon took the United States off the Gold Standard 53 years ago to the day.

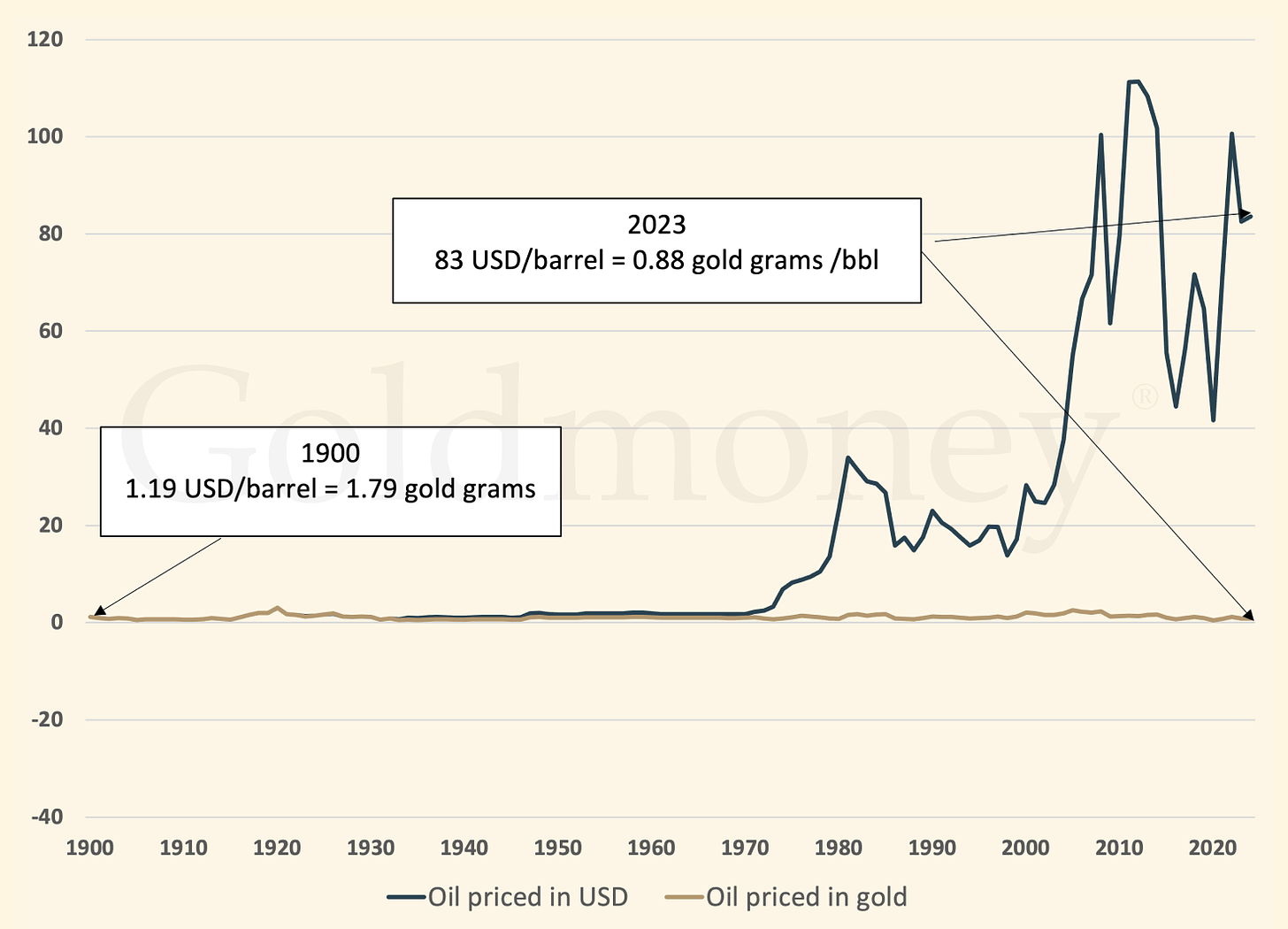

From 1971 until today, the USD has no longer been priced in gold. In our current era, the USD is “fiat money” which is a government-issued currency not backed by precious metals such as gold. The currency is instead backed by the government that issues the currency. Legal tender laws enable a currency to be widely accepted and used as a unit of account. There are over 170 fiat currencies in our world today. However, since 1700, over 600 fiat currencies have collapsed due to conversions, wars, and hyperinflation. Fiat currencies are inherently unstable and eventually collapse. This is a topic for a future article, but Figure 1 below illustrates this point. The chart below measures the price of oil in both gold grams and USD from 1900 until 2023. Gold has proven to be a much more stable unit of account over this period. One barrel of oil cost 1.79 gold grams in 1900 dropping to 0.88 gold grams in 2023. Whereas in 1900 it took $1.19 USD per barrel of oil and in 2023, it took $83.00 to buy one barrel of oil.

Figure 1: Oil Priced in Gold & USD (1900 - 2023)

Source: Goldmoney

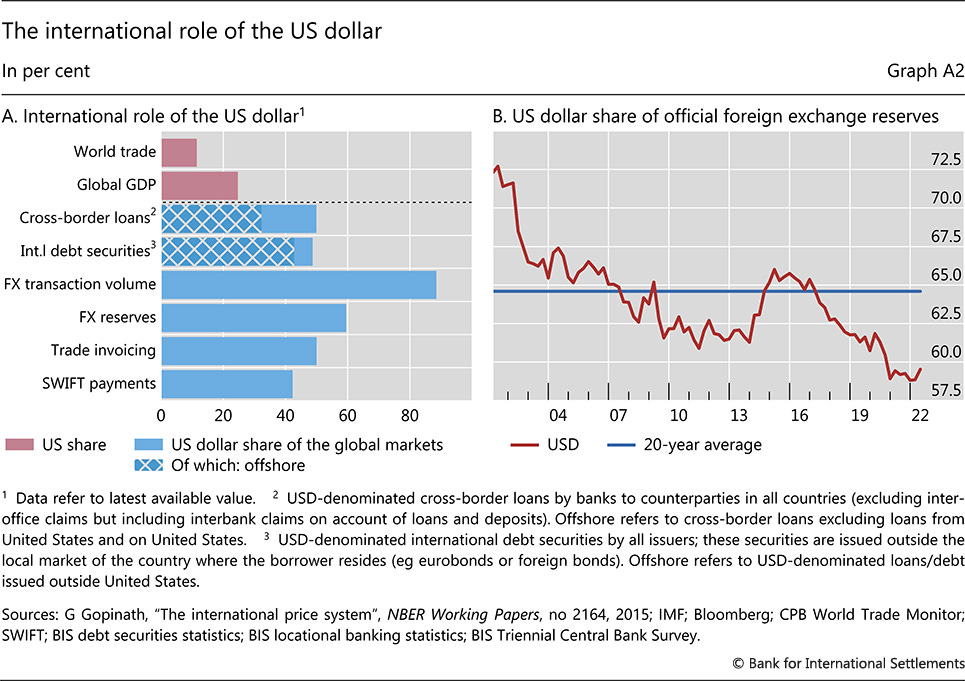

For better or for worse, in today’s society, the most common unit of account is the US Dollar. According to a note published by the Bank for International Settlements (BIS), the USD accounted for roughly 50% of all trade invoices in 2022 (see Figure 2 below).

Figure 2: The International Role of the USD

Source: Bank for International Settlements

Store of Value

The Austrian economist Carl Menger described money as the most universal good that can provide value through space and time. Meaning money can be sent with relative ease across great distances, but also hold its value over long periods. Menger described money as “the most saleable good”. Money should not be confused with investment. An investment is made to grow wealth, while money is used to store wealth. Money must also be very liquid. Liquidity allows us to quickly find a buyer through good economic times or bad without fail.

Means of Payment

A fourth definition comes to us by the way of James Turk. He adds a Means of Payment to Aristotle’s original theory of money. He asserts:

“Keep in mind that from prehistory to the mid-twentieth century, money to Aristotle and everyone else was precious metal coin. So the fourth function - money as a means to complete a payment - was intuitive to almost everyone until precious metal coins stopped circulating. Payment is a critical task that in today’s economy with the use of various types of currency has been widely misunderstood or just simply ignored.”

Turk argues that a means of payment is completed through a tangible asset. Throughout most of history, gold and silver were tangible assets used as a way to provide final settlement. This is no longer true in almost all transactions in today’s financial system. Today, sales are made through national fiat currencies which in and of themselves give the seller a promise to pay typically by a bank, not a final settlement.

There are exceptions to this. Central banks and nation-states still use gold to settle goods and services among their ledgers. Second, individuals are beginning to use cryptocurrencies to circumvent the traditional financial system and fulfill a role as a means of payment.

Sound Money

Lyn Alden argues in her book Broken Money, that a monetary unit should be easily divisible, portable, durable, fungible, verifiable, and scarce. The term “sound money” describes money that can hold its purchasing power and provide a stable value for transactions to occur across space and time. Looking back through history, we see a trend of geopolitical peace coinciding with societies that adhere to sound money principles. However, when money becomes intertwined with the state and is used as a means to enrich a few at the expense of others we find societies that are prone to inflation, decadence, corruption, war, and ultimately ruin.

Today, August 15th, marks the 53rd anniversary of Richard Nixon “temporarily” removing the United States from the gold standard in international trade. Since then, governments across the world have been free to issue fiat currency without the constraint of commodity backing. This is the first time in modern history that a purely fiat monetary system has lasted this long. Investors today would be well served in studying the history of money and especially periods of history that we have not experienced first-hand. Hopefully, this knowledge will enable us to look forward to surviving and thriving in the future monetary system.

¹ Means of Payment was not in Aristotle’s classical theory of money.

References

- Cortines, & Baumer. (2016). God and Money: How we discovered true riches at Harvard Business School. Rose Publishing.

- Revisiting the international role of the US dollar. (n.d.). https://www.bis.org/publ/qtrpdf/r_qt2212x.htm

- Why Precious Metals - Goldmoney. (n.d.). Goldmoney. https://www.goldmoney.com/why-precious-metals

- Turk. (2021). Money and Liberty: In the Pursuit of Happiness & The Theory of Natural Money. James Turk.

- Menger. (2011). The Origins of Money [Kindle]. Ludwig von Mises Institute.

- Alden. (2023). Broken Money: Why our financial system is failing us and how we can make it better.

- Middelkoop. (2015). The Big Reset Revised Edition: War on Gold and the Financial Endgame (2nd ed.). Amsterdam University Press.

DISCLOSURES & INDEX DESCRIPTIONS