History of Money - Election Day Special

Posted:November 5, 2024

Categories: Central Bank, Credit, Economics, Gold, Inflation, Monetary Policy, Money, US Treasuries

“The Congress shall have the power to coin money, regulate The value thereof, and of Foreign coin, and to fix the Standard of Weights and Measures.” The Constitution of the United States of America, Article I, Section 8, Clause 5 (1787)

Twelve years before the drafting of the US Constitution, war broke out between the American Colonies and the British Crown. These were early days in the American Colonies, and producing finances to sustain war was difficult. In 1950, Murray Rothbard described these early days in an essay, where the reported money supply was a paltry 10 million dollars of gold and silver. The early government had shaky credit, so leaders turned to paper money to finance the war and subsequently printed 10 million dollars of paper money, redeemable at par, for specie (gold and silver), dollar for dollar. Rothbard notes the plan was to repay this initial allotment via taxes from 1779 to 1782. These taxes were never levied. Instead, as has happened many times throughout history, the ease of printing money was too tempting.

Rothbard continues, “The Congress issued six million dollars of continentals in 1775, and the issues increased each year. One hundred and forty millions were issued in 1779. As prices rose, the government found that it needed more and more dollars to finance its expenditures. More money was printed. This added supply of dollars led to further depreciation in the infamous spiral of inflation. At the outset, the continental had circulated at par with a dollar of specie. By 1780, over one hundred continental dollars were required to exchange for one specie dollar; Congress had printed continentals until they were worth almost nothing.” Rothbard, M. (1950). Not Worth a Continental. Faith and Freedom.

The phrase “not worth a continental” was fresh in the minds of the Founding Fathers when they empowered the new Congress to “...coin money, regulate The value thereof...” Notice the power to “print currency” was left out, and for good reason. The Founding Fathers knew the dangers of paper money and the power this gave elected officials.

The Gold Standard

During the 17th and 18th centuries, the Age of Enlightenment helped steer countries into the classic gold standard which flourished in the late 19th and early 20th centuries. This era was known for low inflation, high economic growth, and stable monetary systems. Fast forward to the 20th century, and roughly four generations have passed since the founding of our great nation. World War I dealt a major blow to many countries and was the catalyst for the end of the gold standard. Great Britain, France, and Germany printed too much paper money to finance the war, and all eventually broke from the gold standard. In Britain’s case, the British Pound was still the World’s Reserve Currency. Attempting to retain this power, the government in Britain ended up being too stubborn with re-pricing the British pound following the war. Eventually, this error caused an inflationary spiral in the 1920s as the United States headed toward the Great Depression.

Great Britain finally threw in the towel in 1931 and removed itself from the gold standard to stave off economic ruin. The famous father of Keynesian Economics, John Meynard Keynes, was in favor of this decision when he wrote,

“There are few Englishmen who do not rejoice at the breaking of the golden fetters. We feel that we have as last a free hand to do what is sensible…I believe that the great events of the last week may open a new chapter in the world’s monetary history. I have hope that they may break down barriers which have seemed impassable…” John Meynard Keynes, (1931)

When Keynes wrote this controversial statement, four generations had passed since the early leaders penned the Constitution. The further our leaders were generationally removed from the Founding Fathers, the further our monetary system began to become centralized. Keynes knew exactly what this meant. He knew the tremendous power governments had once they took control of a nation’s money. Remember- gold was money during this period in history. Leaders from many nations knew this all too well. James Turk notes in his book Money and Liberty that during the 1930s, gold was confiscated by Hitler in Germany, Lenin in Russia, Mousillini in Italy, and Roosevelt in the US.

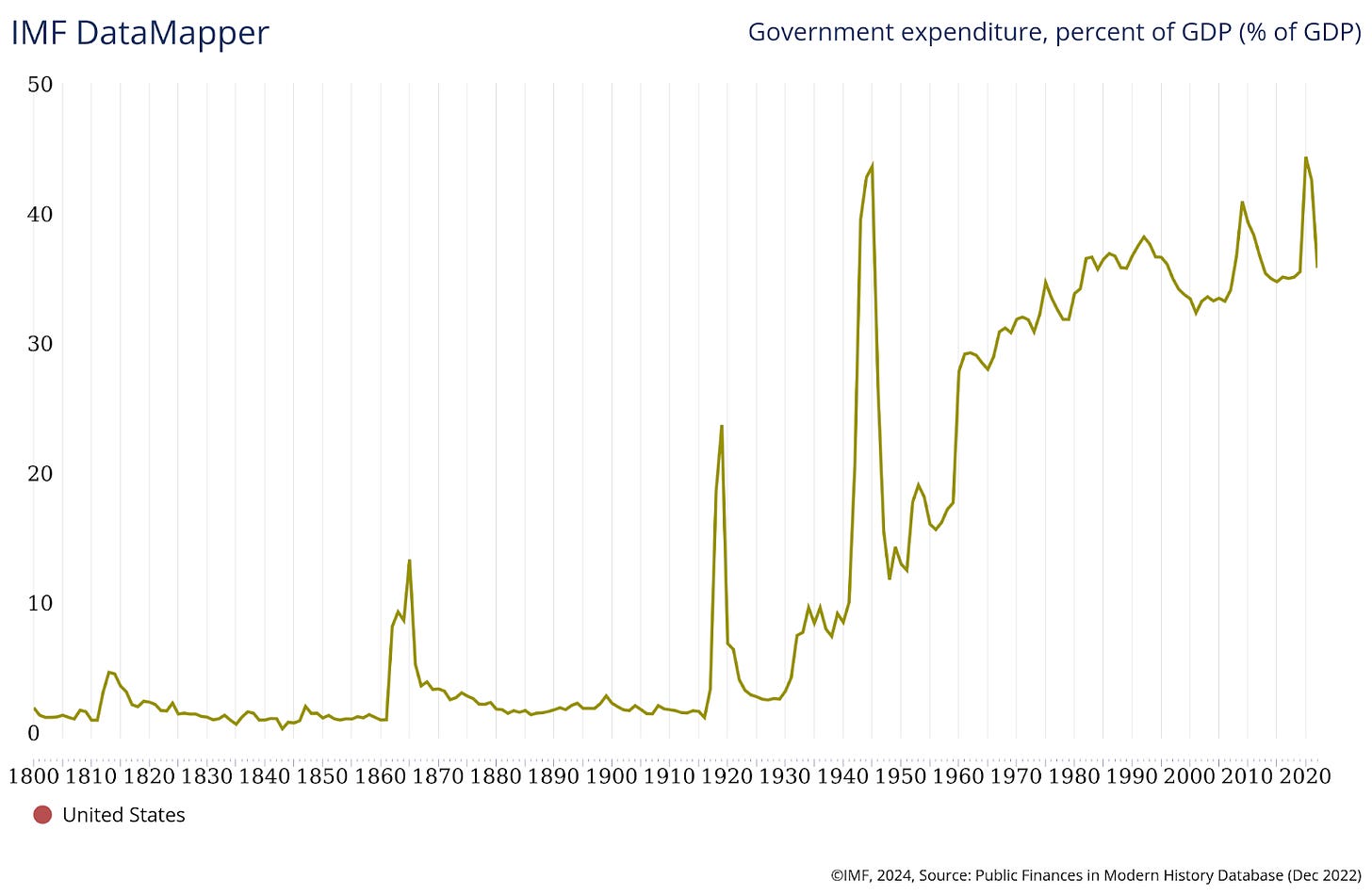

The United States went partially off the gold standard in January of 1934 when President Franklin D. Roosevelt confiscated the nation's gold only to revalue the yellow metal from $20.67 to $35 per ounce to re-liquify the government's balance sheet. It wasn’t until 1971 that President Nixon finally removed the US from the gold standard. Not coincidentally, government spending has risen steadily since 1934, and increased much faster since 1971 (figure 1 below).

Figure 1: US Federal Government Expense (% of GDP)

Source: International Monetary Fund

Liberty and Freedom

The Founding Fathers were advocates of liberty and freedom. Liberty and freedom flourished in the early days of our nation, as did sound money on the gold standard. These ideals seem far from reality in today’s political and economic environment. I am not naive enough to think we can magically return to the gold standard. With $36 trillion in national debt and many more trillions of global debt, the return to the gold standard would be nearly impossible. However, I believe it’s in the best interest of the United States to begin moving back toward liberty and freedom within our monetary system.

Judy Shelton, author of a fabulous new book called Good as Gold, offers an excellent idea that should be considered as a step back to utilizing gold in our monetary system. She recommends the issuance of what she terms “Treasury Trust Bonds.” These bonds would be issued by the US Government, giving the bondholder the option to redeem the face value at maturity in either US dollars, or the prespecified equivalent amount in gold. Backing for these bonds would come from our enormous and unused hoard of 261.5 million troy ounces of gold. She recommends a small, symbolic issuance of 50-year Treasury Trust Bonds to commence on July 4, 2026, and to mature on the 300th anniversary of our great nation, July 4, 2076. Shelton makes some strong arguments in favor of the United States leading the way in bringing gold back into the global monetary system. No, this won’t be a universal remedy to fix our debt problems. Very far from this. She argues that her proposed plan would be more of a symbolic step towards liberty and freedom. She also argues this could be a catalyst for other countries to follow suit and issue similar debt instruments. The US dollar is one of the largest monetary networks the world has ever known. With great power, comes great responsibility. As the steward of the Global Reserve Currency, the United States could be a guiding light for the global debt system to forge its way back toward sound money.

References

- The U.S. Constitution and Other Key American Writings. (2019). [Print]. Printer’s Row Publishing Group.

- Rothbard, M. (1950). Not Worth a Continental. Faith and Freedom. https://mises.org/faith-and-freedom/not-worth-continental

- Bernstein, P. (2000). The Power of Gold: The History of an Obsession [Print]. John Wiley & Sons, Inc.

- Turk. (2021). Money and Liberty: In the Pursuit of Happiness & The Theory of Natural Money. [Print]. James Turk.

- Shelton, J. (2024). Good as Gold: How to Unleash the Power of Sound Money [Print]. Independent Institute.

- Government expenditure, percent of GDP. (2022). [Dataset; Online]. International Monetary Fund. https://www.imf.org/external/datamapper/exp@FPP/USA

DISCLOSURES & INDEX DESCRIPTIONS