Global Credit Outlook - Q4 2024

Posted:November 21, 2024

Categories: Bond Market, Bonds, Cash, Central Bank, Credit, Currencies, Economics, Federal Reserve, Fiat Currency, Gold, Government Bond Yields, Inflation, Interest Rates, US Dollar, US Treasuries

The Federal Reserve surprised markets in mid-September cutting interest rates by 0.50%. With the stock market near all-time highs and the economy humming along, a 0.50% rate cut seemed extreme. Since that decision, the bond market “vigilantes” have been in full force with the 10-year US Treasury bond moving from 3.6% to 4.4%.

Why have interest rates risen?

- Market expectations of sticky inflation. The market thinks the Fed can’t cut rates into a higher inflationary environment.

- The market is pricing in fewer rate cuts compared to mid-September.

- Future concerns regarding the budget deficit.

- An increased amount of US Treasury bill (short-term debt) issuance relative to US Treasury bond coupon issuance (long-term debt). Issuing debt on the short end “starves” the long end, thus driving rates higher.

Bottom line: Investors are demanding higher rates as they move further out on the risk curve and buy longer-term bonds.

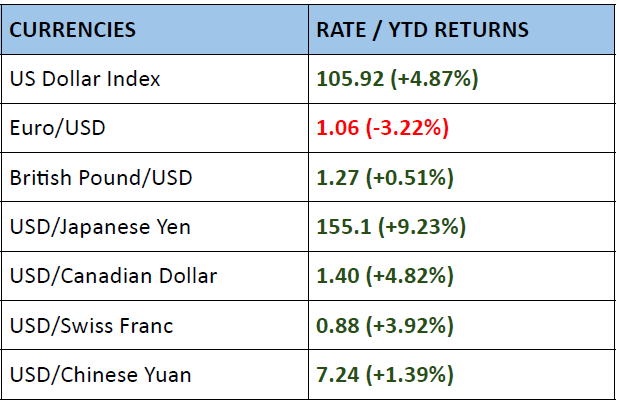

Rising Rates & US Dollar

With President Trump winning the election, the US dollar has risen roughly 5-6%. This is a major move in such a short time for the global reserve currency. Below is a chart showing the US Dollar Index. The US Dollar Index is the US dollar compared to a “basket” of currencies (Euro, Yen, Pound, etc.). A rising US Dollar Index means the US dollar is appreciating vs. foreign currencies.

Why is the dollar rising?

- As noted above, interest rates have risen. When interest rates rise, in general, so does the US dollar.

- Trump wants to use tariffs as a big part of his economic policy. No matter the speed or size, many tariffs cause the dollar to rise. Why? As imports are taxed, less dollars flow to the rest of the world. The lower the supply of dollars, the higher the US dollar price.

- Trump is viewed as pro-business. His “Make America Great Again” potentially means bringing back manufacturing jobs, smaller deficits, lower taxes, and deregulation. If successful, US companies may attract more capital which is also good for the US dollar.

Figure 1: US Dollar Index (5-Year)

Source: TradingView

It’s still too early to tell what a Trump presidency will mean for interest rates, the US dollar, and geopolitics. Clearly, he wants a stronger America. Advancing his bold agenda in a complex global economy with the USD as the reserve currency will be tough. The US also has quite a bit of bonds to sell with roughly 30% of our $36 trillion in debt coming due in the next year or so.

Too strong of a dollar may slow down global markets. A rising dollar increases debt servicing costs for the rest of the world. As I’ve said many times, we live in a debt-based global monetary system. Any rise in the cost of debt servicing will cause a drop in liquidity and thus a drop in the flow of capital to risk assets such as stocks. I’m certainly not advocating selling stocks, quite the opposite. Financial markets are very complicated. Making major portfolio decisions based on who is in the White House is never prudent. Many of Trump’s policies are positive for the United States and should be positive for the stock market. Yes, US stocks are pricey, but they’re pricey for good reasons!

Bottom line: Trump should strive to achieve a “range-bound” US dollar (not too high, not too low). He should also strive to put forward policies and people with acumen in the global bond market to suppress volatility and yields within a range. Yields need to be high enough to entice buyers, but not too high to stretch our budget deficit further.

Bond Market Overview & Performance

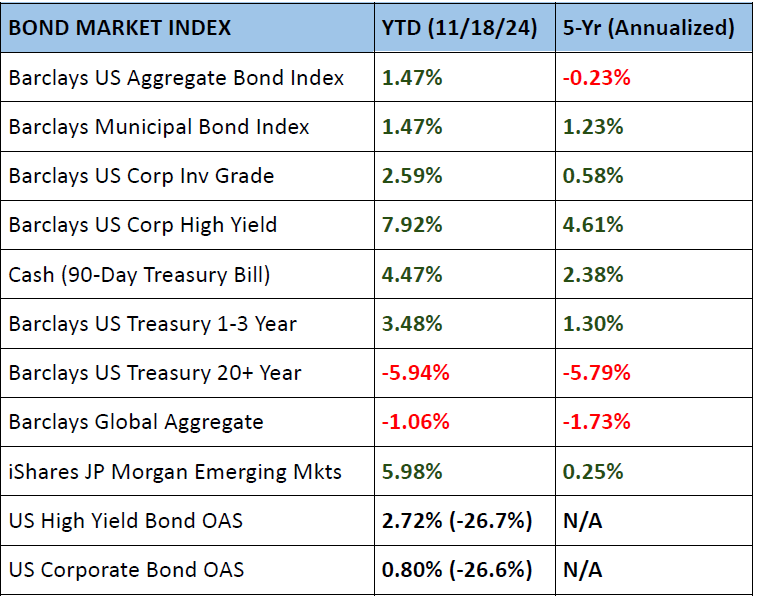

The US Aggregate bond market is up 1.5% year to date and flat since 2019. High-grade corporate and municipal bonds are showing similar returns this year. Cash and short-term debt have proven to be resilient benefiting from higher rates. With euphoria high and “risk on,” spreads have continued to tighten in corporate and high-yield bonds.

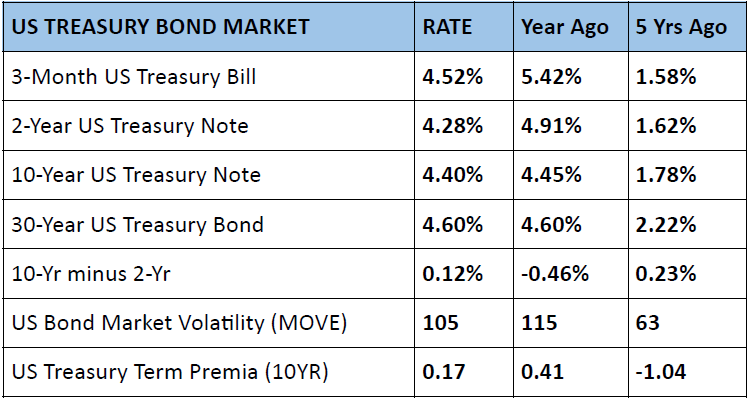

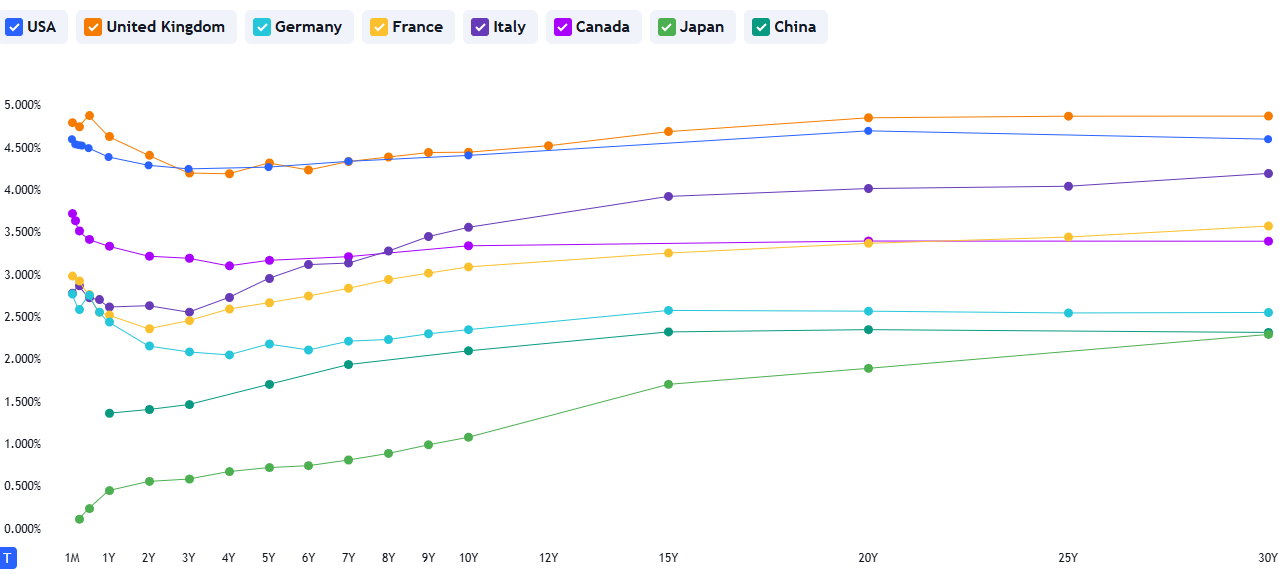

US Treasury Market

The US Treasury yield curve has flattened out since the beginning of the year with the 3-month bill yielding 4.52% and the 30-year yielding 4.60%. The “belly” of the curve is lower due to expectations of future rate cuts. However, yields are now in a very tight range between roughly 4.3% and 4.6%. Longer rates have moved higher as mentioned earlier. At some point, this will start to attract yield-sensitive buyers.

Figure 2: US Treasury Yield Curve (as of 11/19/2024)

Source: ustreasuryyieldcurve.com

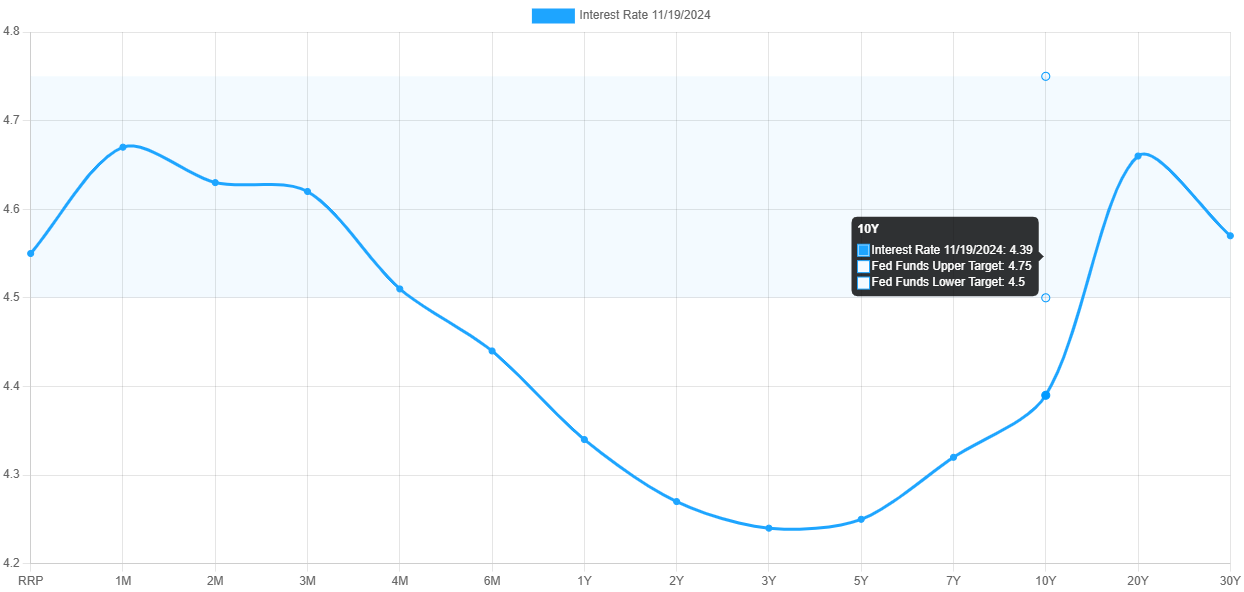

Figure 3: World Yield Curves (as of 11/19/2024)

Source: TradingView

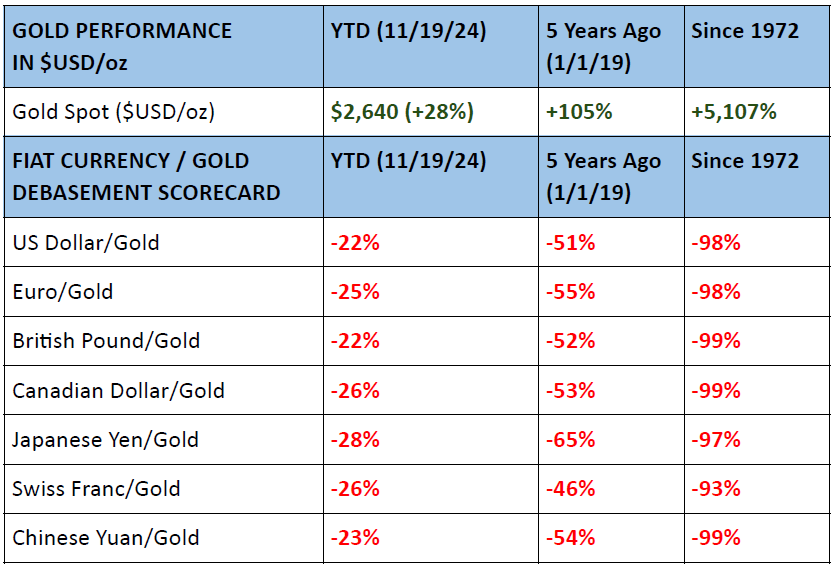

Gold vs Fiat Currencies

Spot gold has risen 28% vs. the US dollar year to date. Gold sits right around $2,640 per troy ounce in trading. The price of gold is simply the inverse of the dollar. In other words, when gold is rising, the dollar is dropping. Gold is seen by many as “world money.” Therefore, gold can be priced in any fiat currency. The scorecard below simply looks at the historical monetary inflation pumped into fiat currencies. In a debt-based monetary system, fiat currency regimes require rising debt and more currency to grow. The more supply, the lower the value of the currency relative to gold or any good or service.

To prove this point, see the chart below. US federal debt (blue line) was approximately $5 trillion in 1994. The stock of debt has grown roughly 7 times to $35 trillion which is very close to the growth rate for the price of gold over that same period. Gold has risen from approximately $375 to $2,650. The correlation ebbs and flows, but gold generally provides a good hedge against monetary inflation.

One final point to make. I’ve argued above for a “strong dollar” and then told you gold has risen substantially vs. the dollar. What gives? The US Dollar Index referenced earlier in this article compares the dollar vs. other fiat currencies (Euro, Yen, Yuan, etc.). This is important. In a global market where all fiat currencies are floating freely without gold backing, it’s a relative game. The US dollar can be strong relative to all the other currencies and rise at the same time gold is rising.

Figure 4: Gold & US Federal Debt (30-Years)

Source: TradingView

References

US Treasuries Yield Curve. (2024). [Dataset; Online].

https://www.ustreasuryyieldcurve.com/

- Federal Reserve Bank of New York. (2024). Treasury Term Premia [Dataset; Online]. https://www.newyorkfed.org/research/data_indicators/term-premia-tabs#/overview

- fxtop.com

- Kwanti Portfolio Analytics

- TradingView

DISCLOSURES & INDEX DESCRIPTIONS