Central Bank Watch - December 2024

Posted:December 18, 2024

Categories: Bond Market, Central Bank, Credit, Economy, Government Bond Yields, Interest Rates, Monetary Policy, US Treasuries

United States

Today, the U.S. Federal Reserve lowered the benchmark interest rate by 0.25% to a target rate of 4.25% to 4.50%. The market widely anticipated this move. The Fed currently focuses on unemployment and feels this rate level is restrictive. While price inflation has come closer to its 2% target, asset price inflation and monetary inflation continue to rise. One only has to glance at recent returns in risk assets to see asset price inflation at work. Further, non-US central banks have been cutting rates due to stagnant growth globally. The Fed’s “dot plot” projections indicate two rate cuts for 2025, two in 2026, and one in 2027 to arrive at a 3% “neutral” rate. These projections are more “hawkish,” which appears prudent given that historically, cutting rates too aggressively into a bull market has turned out poorly.

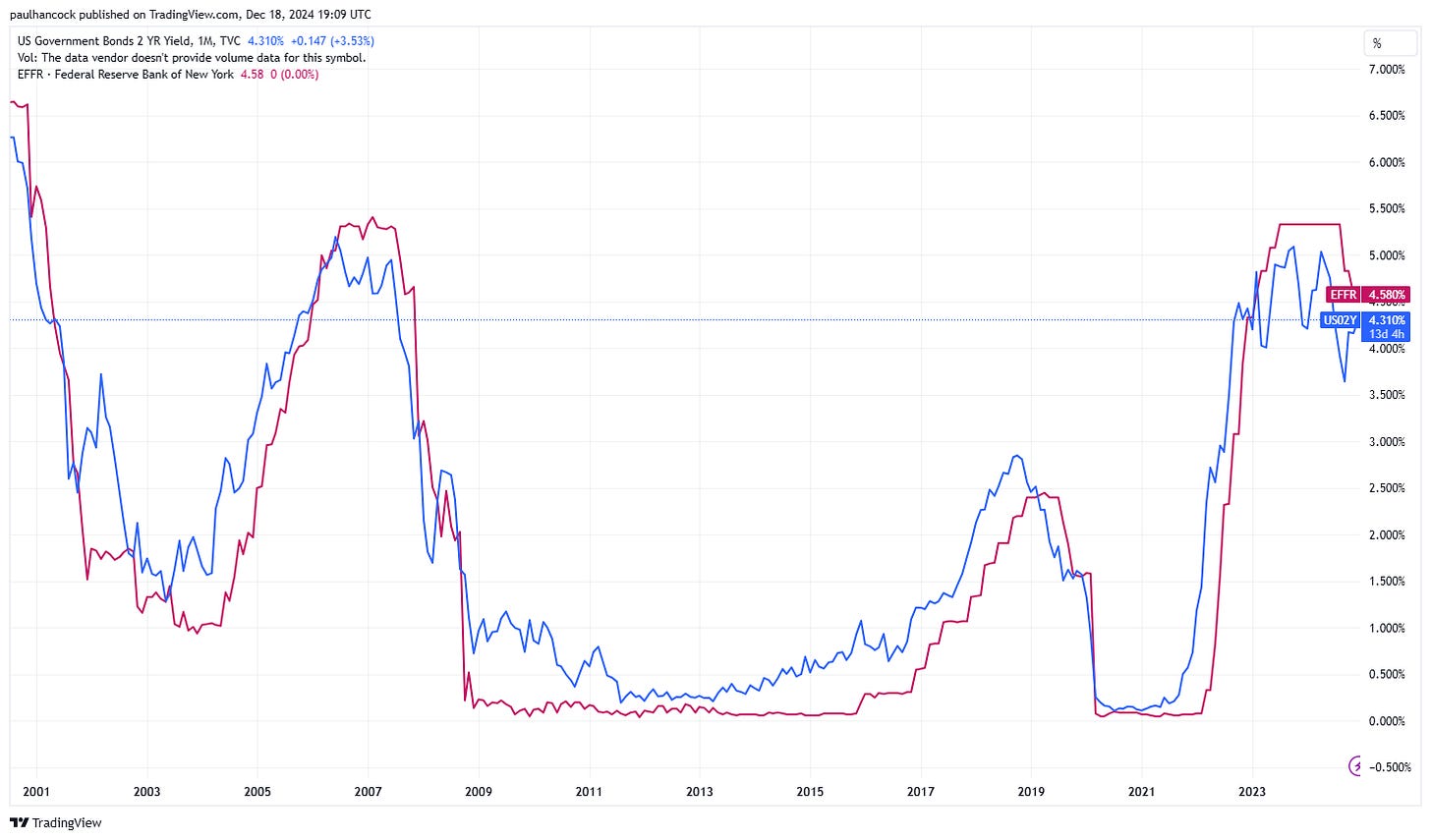

As I’ve shown, the Fed Funds rate closely follows the 2-year US Treasury rate, which rose after the decision to around 4.30% (figure 1). The 2-year Treasury and the Fed Funds rate are closely aligned with this rate cut by the Fed. The longer end of the US Treasury curve isn’t buying this move, as the 10-year has gone from 3.6% to 4.45% since the rate cuts kicked off. This type of move in the bond market could be a harbinger for the future. Watching the 2-year and 10-year rates will be key in the coming months.

Figure 1: Fed Funds + 2-Year US Treasury Rate

Source: TradingView

China

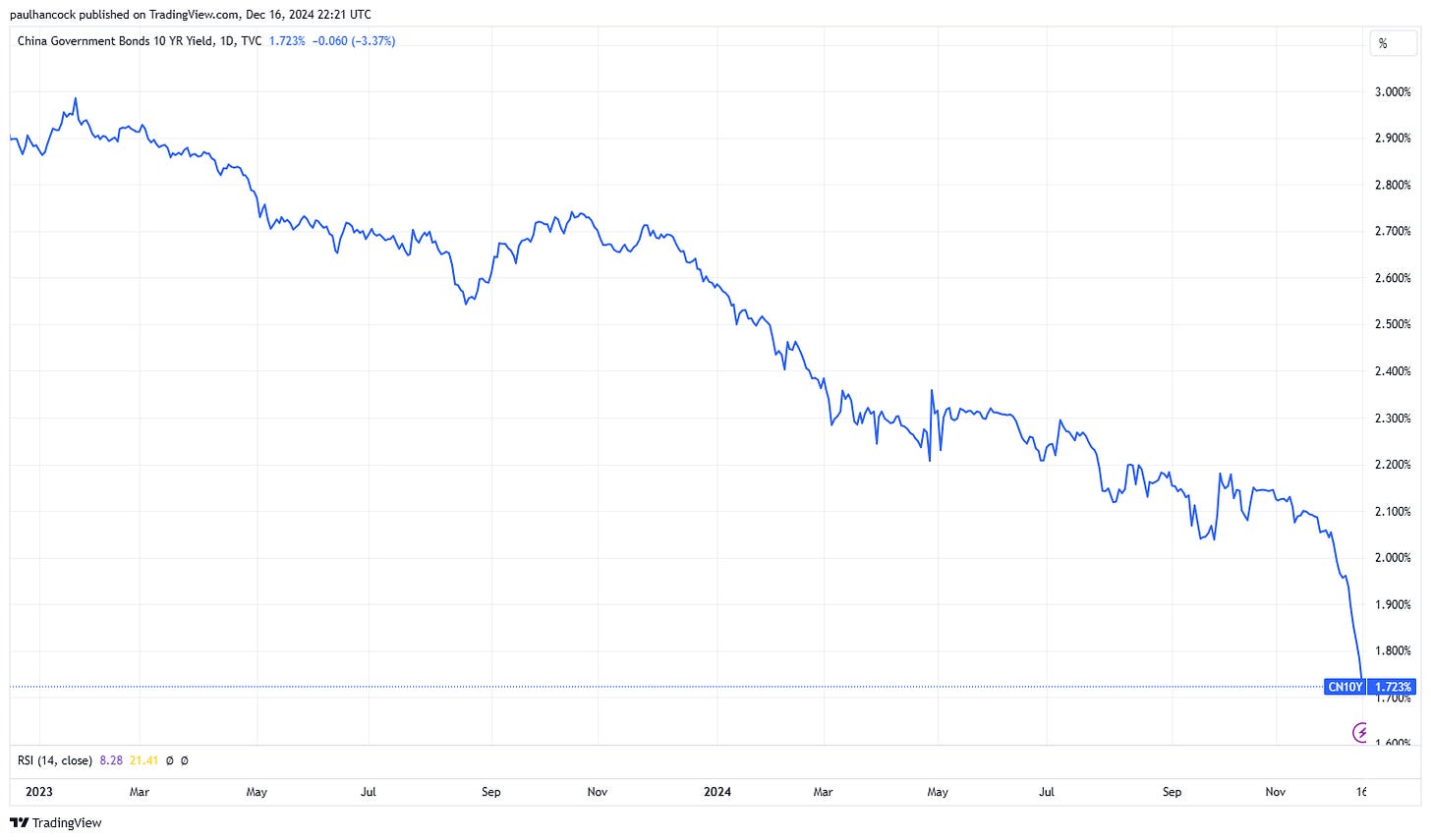

The People’s Bank of China continues to project monetary and fiscal stimulus, but the market seems annoyed by lots of talk and little action. Clearly, we are moving into a different world regarding global trade, with President Trump promising tariffs on a wide scale. As China is the largest exporter in the world and runs a massive trade surplus with the United States, some investors are spooked. As discussed in previous articles, China is reeling from a deflationary economy after its property bubble burst. Things are getting worse with weak domestic demand and a strong US Dollar. The benchmark 10-year Chinese government bond has plunged below 2% (figure 2), signaling further issues ahead. China remains a large user of the US dollar, and a strong dollar harms its export-driven economy. I’ve argued in past articles that China needs to devalue its currency to support exports. Earlier this month, it was widely reported in the financial media that China is considering allowing the Yuan to depreciate by roughly 3-4% vs. the US dollar. This would bring the exchange rate closer to 7.50 USD/CNY, a level not hit since late 2007. China would also welcome the incoming administration in the United States to add liquidity and weaken the US dollar.

Figure 2: China 10-Year Government Bond Yield

Source: TradingView

Eurozone

Last week, the European Central Bank (ECB) cut rates to 3.0%, its fourth 25 basis point (0.25%) cut this year. Growth is slowing in Euroland, and the ECB is projecting lower inflation and growth in the coming few years. Countries like Germany see two potential issues on the trade front: tariffs by the United States and a weak Chinese economy. The ECB is projecting further rate cuts to come in 2025.

Canada

The Bank of Canada cut interest rates by 0.50% this month. The economy is struggling, and inflation has been very low. Growth has been sluggish, and unemployment is rising, partly due to a large amount of immigration into the country. Canada’s economy and currency tend to be strong during periods of higher commodity prices.

Switzerland

The Swiss National Bank surprised markets with a 0.50% rate cut earlier this month. Their central bank rate sits at 0.50%. For a smaller country, monetary policy is crucial to manage their exchange rate. Their Swiss Franc currency has historically been a “safe haven” currency. With the rest of the Eurozone having economic struggles, money has flowed into Switzerland, pushing the exchange rate against the Euro and the Dollar. This hurts their export competitiveness, and thus, they are lowering interest rates.

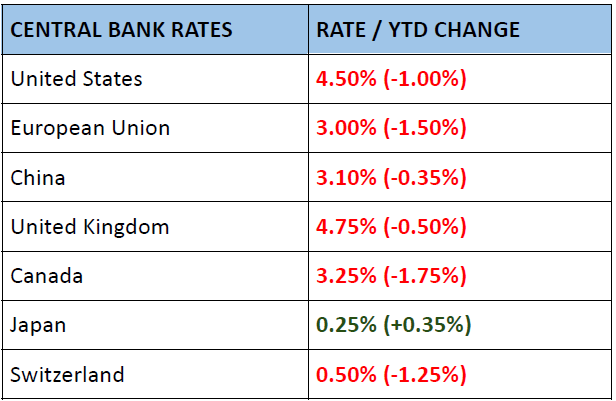

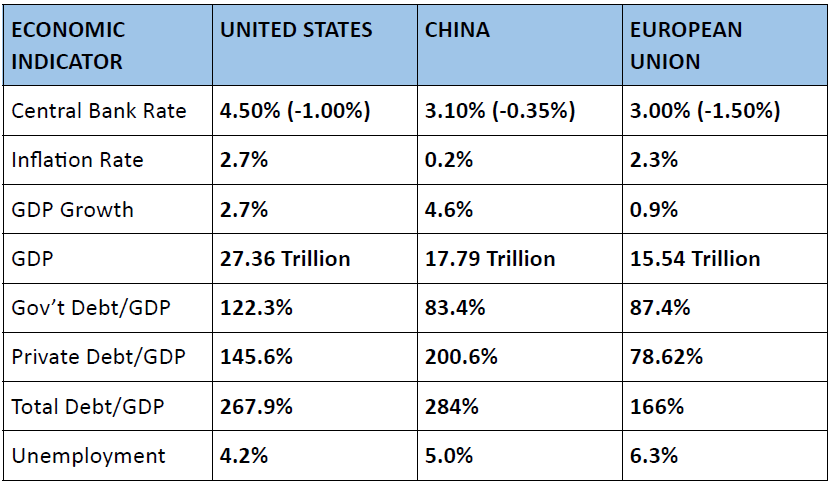

Central Bank Data

The tables below show current central bank rates and general economic indicators for the US, China, and the EU.

References

- TradingView

- CEICdata.com

DISCLOSURES & INDEX DESCRIPTIONS

For disclosures and index definitions please click here.

Opinions expressed herein are solely those of Genesis Wealth Planning, LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. Written content is for information purposes only. Past performance is no guarantee of future results. Diversification does not assure profit or protect against a loss in a declining market. While we have gathered this information from sources believed to be reliable, we cannot guarantee the accuracy of the information provided. The views, opinions, and forecasts expressed in this commentary are as of the date indicated, are subject to change at any time, are not a guarantee of future results, do not represent or offer of any particular security, strategy, or investment, and should not be considered investment advice. Investors should consider the investment objectives, risks, and expenses of a mutual fund or exchange-traded fund carefully before investing. Furthermore, the investor should make an independent assessment of the legal, regulatory, tax, credit, and accounting and determine, together with their professional advisers if any of the investments mentioned herein are suitable to their personal goals. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not reflect fees or expenses. To receive a copy of Genesis Wealth Planning ADV Part II which contains additional disclosures, proxy voting policies, and privacy policy, please contact us. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.