A Time for Everything

Posted:January 20, 2025

Categories: Central Bank, China, Economy, Gold, Inflation, Stock Market, US Dollar

“1 To everything there is a season, a time for every purpose under heaven:

2 a time to be born, and a time to die; a time to plant, and a time to uproot what is planted;

3 a time to kill, and a time to heal; a time to break down, and a time to build up;

4 a time to weep, and a time to laugh; a time to mourn, and a time to dance;

5 a time to cast away stones, and a time to gather stones; a time to embrace, and a time to

refrain from embracing;

6 a time to gain, and a time to lose; a time to keep, and a time to cast away;

7 a time to tear, and a time to sew; a time to keep silence, and a time to speak;

8 a time to love, and a time to hate; a time of war, and a time of peace.”

Ecclesiastes 3:1-8 (FireBible: Modern English Version)

This verse from Ecclesiastes came to mind this weekend while preparing this article. I’ve applied this verse and shared it with my kids when life throws us curveballs- friends move away, vacations end, parents pass, arguments arise, etc. Times are changing in our country as President Trump is inaugurated today, a new administration enters the White House, and the balance of power shifts. The main purpose of this article is to discuss a few possible changes with the new administration and their effects on the economy and financial markets. Lastly, it’s important to separate politics from investing. Both can be emotional, and emotions can be very negative for long-term investors.

The current geopolitical landscape is filled with uncertainty, mainly surrounding what a Trump 2.0 Administration will look like. He’s already been busy discussing tariffs, the dollar, export controls, sanctions, energy independence, etc. Seeing what’s forming in Washington is encouraging. As I’ve stated in a past report, his leadership appears to be a conglomerate of “working class, entrepreneurs, and patriots against the managerial class and status quo.” This is similar to the socio-economic structure of our nation in its infancy- everyone working together to grow a nation out from under the thumb of tyranny and elitism.

A recent report from Michael Every of RaboResearch fits this re-booted Washington narrative. His report highlights the need for this group of leaders to be laser-focused on asking “what GDP is for” and how it works through what he calls the “Grand Macro Strategy.”

“Grand strategy - identifying national interests and how to achieve them within the international system by using three tools: the economy, in tandem with political and military power.” (Michael Every, 2024)

More specifically, this strategy sets policies around trade (tariffs, subsidies, export controls, etc.), capital (aid, loans, capital controls, etc.), and other (monetary & fiscal policies, foreign exchange, etc.). When a nation’s entrepreneurs are behind these strategies, it becomes easier for them to work together for the common good. Michael Every’s report argues we are much closer to a geopolitical world like the Cold War in the 1970s. From the standpoint of the rest of the world, this undoubtedly creates more uncertainty.

This article discusses three specific types of macroeconomic policies: DOGE, tariffs, and the US dollar.

DOGE Timing

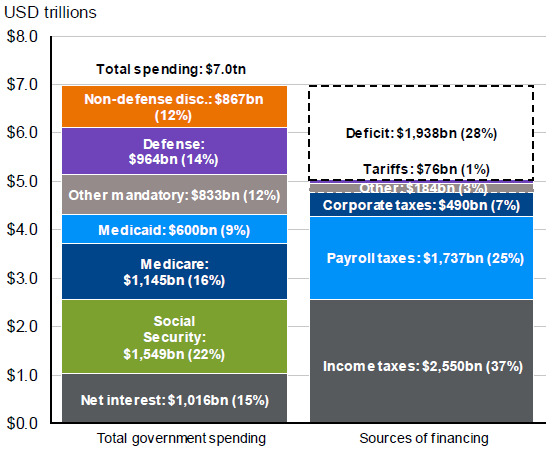

One of the more highly publicized policy tools the Trump administration plans to use is a newly created Department of Government Efficiency or “DOGE.” Elon Musk and Vivek Ramaswamy are set to lead this effort to reduce government spending by $2 trillion annually. Recent reports have stated they have backed off this number, so let’s use $1 trillion to contextualize it. Figure 1 below shows the 2025 federal budget. Let’s assume only interest is untouchable. Out of a $7 trillion budget, it leaves you with $6 trillion but only $867 billion in discretionary spending to cut. They could cut some non-discretionary spending, which may prove difficult, especially entitlement programs and defense. The point here is that there are definitely places to cut, but maybe not as much as the first envisioned.

More importantly, the timing of the DOGE cuts is much more important than what gets cut. With a GDP of $27 trillion and a budget deficit of 7%, a $1 trillion cut is about 4% of GDP. This large cut will ultimately negatively affect tax receipts and lower income, counterproductive to DOGE's goal. Further, a $1 trillion cut will likely push our economy into a recession. History proves that the budget deficit increases during a recession, which is the opposite goal. Furthermore, a recession will most likely increase the dollar, which, all things being equal, will increase interest rates and increase interest outlays.

With a huge and rising government debt load, DOGE must be careful not to cut too quickly. Debt is not bad in and of itself. Debt is the lifeblood of our current global economy. However, unproductive debt is extremely bad for the economy. Work must first be done on lowering debt, improving debt productivity, and increasing tax receipts (income). A currency deal with China could work, where the dollar is either devalued against the Yuan, or both are devalued vs. gold. This would be inflationary, but much more so in terms of monetary inflation. An increase in monetary inflation will be good for markets and, thus, good for tax receipts. If debt growth is slowed and/or the deficit narrows, this would allow the DOGE committee to do some more serious work. However, massive cuts right away seem extreme and counterproductive.

Figure 1: 2025 Federal Budget

Source: J.P. Morgan Asset Management

Budget Deficit & Tariffs

The US has a trade deficit of around $1 trillion annually and has been running a trade deficit for many years. The trade deficit grew as China entered the World Trade Organization (WTO) in 2001. China produced cheap goods that the US bought, sending dollars to China, and China recycled much of those dollars into US Treasury bonds. This was good for China and the United States, as well as interest rates and risk assets. However, this has not been good for our industrial base and, arguably, the middle class. Structural deficits and surpluses can’t last forever.

One way to tighten deficits and bring jobs back to America is through tariffs. Opponents of tariffs argue this will increase prices and inflation as less goods enter the economy. Proponents say this will create opportunities for foreign companies to build factories in the United States, thus creating jobs. Both arguments have merit. Like cutting debt and expenses, the issue surrounding tariffs is uncertain and difficult to time and determine effects on financial markets. More will be known in the coming months. However, I urge caution, especially related to China, where we import roughly $500 billion per year. Phasing in tariffs over a known time, say at 5% per year, would be wise with China. The US could be more aggressive with countries like Canada and Germany, as they are starting from a weaker point in terms of negotiation as they need to export goods to the United States as China picks up its global competitiveness. One factor that will help the new administration is the recent strength of the US dollar, which is my last topic.

U.S. Dollar

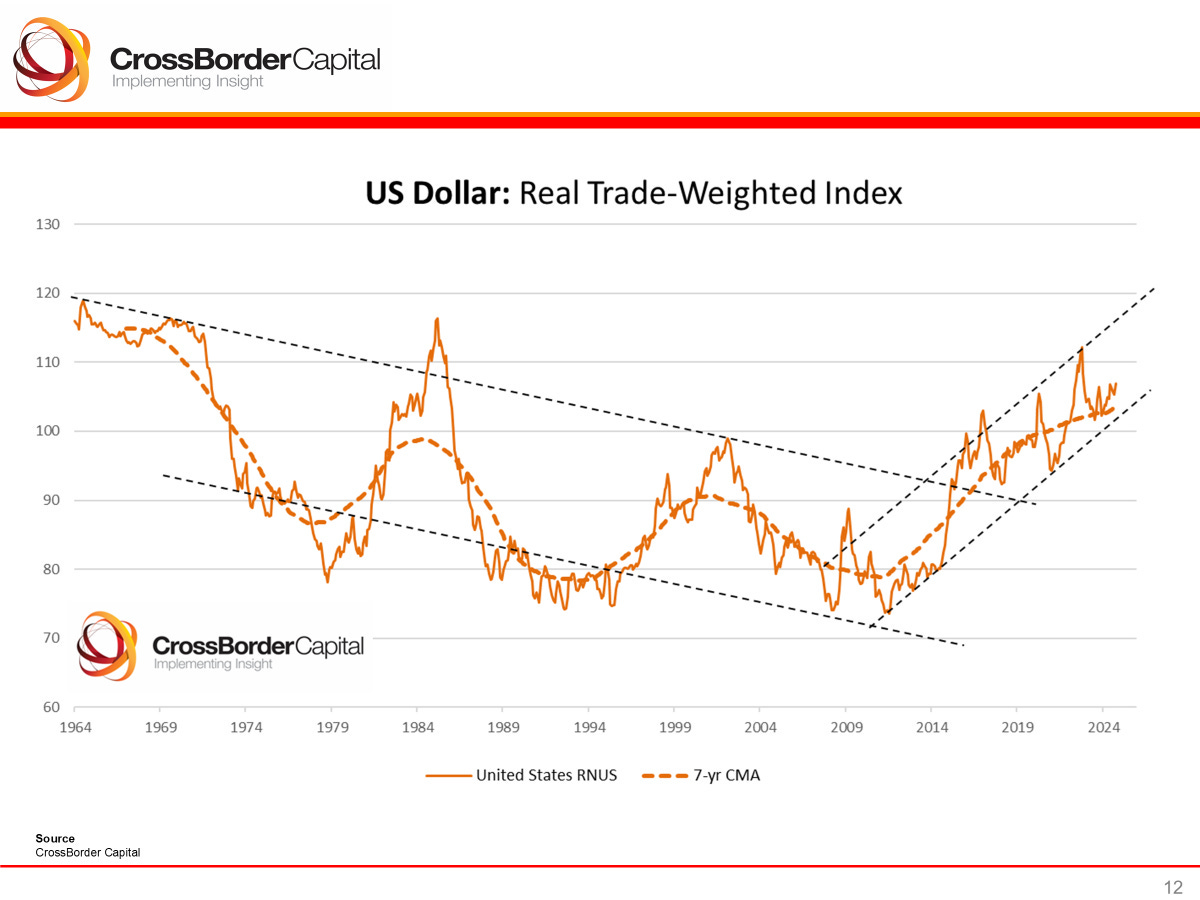

The dollar has been on a tear since the election and ever since the Global Financial Crisis in 2009. Figure 2 below shows the real trade-weighted dollar index. This strength has boosted asset prices, including in the United States stock market. However, a too-strong dollar wreaks havoc on the global economy.

Why is a strong dollar bad for the global economy? Post-1971, the dollar was cemented as the global reserve currency. Remember, for money to have value, it must possess three characteristics. It must be a medium of exchange, a unit of account, and a good long-term store of value. The dollar became the global currency for trade settlement, a medium of exchange, and a unit of account. Meanwhile, US Treasury bonds became the store of value on central bank balance sheets. What also emerged was a debt market outside the US banking system called “Eurodollar bonds.” These are US dollar-denominated bonds (debt) issued by foreign banks to foreign companies in US dollars. When foreign companies earn revenue in a foreign currency that is losing value relative to the US dollar, it can be difficult to service that debt. Therefore, a weaker dollar, all things being equal, is good for global companies, liquidity, and global growth in general.

The chart below shows that the strong dollar was a real problem in the mid-1980s during the Reagan administration. The dollar was much too strong against the Yen and European currencies. in 1985, global leaders engineered a deal during the Plaza Accord to structurally weaken the dollar. The incoming Treasury Secretary, Scott Bessent, has expressed excitement about this role. He believes the world is at an important inflection point, much like Bretton Woods in 1944 and the Plaza Accord in 1985. Trump is a dealmaker, and I believe some kind of currency deal with China will occur over the next four years. There are wide-ranging possibilities for the outcomes, but both currencies may ultimately be devalued against gold as China and the United States need to continue printing paper money and increase monetary inflation.

Figure 2: US Dollar Index

Source: CrossBorder Capital

Conclusion

With mid-term elections two years out, Trump will most likely front-load his policies, which, all things being equal, creates uncertainty. To be clear, I believe these changes will help our country in the future. But with any great change comes uncertainty and sometimes short-term pain. I also believe in reigning in our debt and spending habits. Hopefully, the “DOGE” committee will start working toward these goals measuredly. While monetary inflation and more money printing appear to be baked into the cake, gold still has a role to play in the global monetary system. If the next administration of elected leaders in our great country does not guide our nation back onto the path of liberty, freedom, and sound money, we are in danger of entering a debt spiral. We must remember that the prosperity and financial security our nation once worked so hard to preserve can be our reality again. This matters to every citizen who makes up the political body of our country. Forging a path back to the ideals our Founding Fathers designed in our God-inspired Constitution and using sound money in our monetary system would be a step back to the true path to prosperity.

References

- Michael Every. (2024). Macrostrategy vs. Grand Macro Strategy. RaboResearch.

- FireBible: Modern English Version. The Holy Bible. 2020. Life Publishers International. Springfield, MO.

DISCLOSURES & INDEX DESCRIPTIONS